量化学习 | 配对交易 backtrader实现

配对交易,其基本原理就是找出两只走势相关的股票。这两只股票的价格差距从长期来看在一个固定的水平内波动,如果价差暂时性的超过或低于这个水平,就买多价格偏低的股票,卖空价格偏高的股票。等到价差恢复正常水平时,进行平仓操作,赚取这一过程中价差变化所产生的利润。

其实就是找到两个关联性高的股票A和B,做出调仓策略,如果觉得当前A价格过高就换B,这里的假设是历史走势相关性高,那么未来也是相关性高的,这里并不无道理,如果现在的价格是相关的,未来短期相关的假设是可以接受的。

那我们可以用tushare获取银行行业的股票,基本面相同的情况下,我们认为其走势相关性更高,再在这个范围找出两个相关性高的股票。

本文大部分分析都是根据这篇文章做出的:https://bigquant.com/community/t/topic/260

我这里首先封装了一下tushare的常用获取接口后面通过**from stock_api import ***来获取

import tushare as ts

mytoken = 'your_token'

ts.set_token(mytoken)

pro = ts.pro_api()

def get_daily(ts_code, start_date, end_date):

# get stock daily price and other info from start_date to end_date

try:

df = pro.daily(ts_code=ts_code,

start_date=start_date,

end_date=end_date)

except Exception as e:

print('Retry, We get error:', e)

df = get_daily()

return df

def get_stock_basic():

# get all stock basic info

try:

df = pro.stock_basic(

exchange='',

list_status='L',

fields='ts_code,symbol,name,area,industry,list_date')

except Exception as e:

print('Retry, We get error:', e)

df = get_stock_basic()

return df

def get_daily_basic(trade_date):

# get all stock daily_basic info

try:

df = pro.daily_basic(

ts_code='',

trade_date=trade_date,

fields='ts_code,trade_date,turnover_rate,volume_ratio,pe,pb')

except Exception as e:

print('Retry, We get error:', e)

df = get_daily_basic(trade_date)

return df

def get_income(code, start_date, end_date):

try:

income = pro.income(ts_code=code,

start_date=start_date,

end_date=end_date,

fields='ts_code,basic_eps,diluted_eps')

except Exception as e:

print('Retry, We get error:', e)

income = get_income(code, start_date, end_date)

return income

获取行业股票构造字典

import backtrader.plot

import matplotlib

import matplotlib.pyplot as plt

import tushare as ts

from datetime import datetime

import backtrader as bt

import pandas as pd

import os

from stock_api import *

import numpy as np

import statsmodels.api as sm

import seaborn as sns

data = get_stock_basic()

last_year = '20180101'

start_date='20190102'

end_date='20200103'

instruments_code_bank = list(data[data.industry=='银行']['ts_code'])

prices_temp=pd.DataFrame()

for c in instruments_code_bank:

c_daily = get_daily(c,start_date,end_date)

prices_temp=prices_temp.append(c_daily)

prices_temp_code_close=prices_temp[['ts_code','close']]

# 获取20190102-20200103的股票出现最多的交易日期长度

# 因为有一些20190102以后中途出现停牌的情况

mode_num = np.argmax(np.bincount([len(i) for i in [prices_temp_code_close[prices_temp_code_close.ts_code==c] for c in instruments_code_bank]]))

print(mode_num) # 246

# 构造字典通过ts_code索引这一年的收盘价

price_dict_all = dict(list(prices_temp_code_close.groupby('ts_code')['close']))

# 筛选出字典中交易日期跟众数相等的股票,这样才可以分析出更多再股票池里相关性高的一对

price_dict = dict(filter(lambda x:len(x[1])==mode_num, price_dict_all.items()))

instruments_code=list(price_dict.keys())

print(instruments_code)

银行股票代码是下面这个列表:

['000001.SZ', '002142.SZ', '002807.SZ', '002839.SZ', '002936.SZ', '600000.SH', '600015.SH', '600016.SH', '600036.SH', '600908.SH', '600919.SH', '600926.SH', '601009.SH', '601128.SH', '601166.SH', '601169.SH', '601229.SH', '601288.SH', '601328.SH', '601398.SH', '601577.SH', '601818.SH', '601838.SH', '601939.SH', '601988.SH', '601997.SH', '601998.SH', '603323.SH']

相关性分析

# 输入是一price_dict,每一列是一支股票在每一日的价格

def find_cointegrated_pairs(price_dict):

# 得到price_dict长度

n = len(price_dict)

# 初始化p值矩阵

pvalue_matrix = np.ones((n, n))

# 抽取列的名称

keys = list(price_dict.keys())

mode_num = np.argmax(np.bincount([len(i) for i in list(price_dict.values())]))

print("keys:",keys)

# 初始化强协整组

pairs = []

# 对于每一个i

for i in range(n):

# 对于大于i的j

stock1 = price_dict[keys[i]]

if len(stock1)!=mode_num:

continue

for j in range(i+1, n):

# 获取相应的两只股票的价格Series

stock2 = price_dict[keys[j]]

if len(stock2)!=mode_num:

continue

# 分析它们的协整关系

result = sm.tsa.stattools.coint(stock1, stock2)

# 取出并记录p值

pvalue = result[1]

pvalue_matrix[i, j] = pvalue

# 如果p值小于0.05

if pvalue < 0.05:

# 记录股票对和相应的p值

pairs.append((keys[i], keys[j], pvalue))

# 返回结果

return pvalue_matrix, pairs

pvalues, pairs = find_cointegrated_pairs(price_dict)

pairs_df = pd.DataFrame(pairs, index=range(0,len(pairs)), columns=list(['bank1','bank2','pvalue']))

#pvalue越小表示相关性越大,按pvalue升序排名就是获取相关性从大到小的股票对

pairs_df=pairs_df.sort_values(by='pvalue')

pairs_df

这里是相关性分析,每个股票之间都做sm.tsa.stattools.coint的协整性关系计算,p值小于0.05的放进pairs里考虑,p值越小相关性越高。

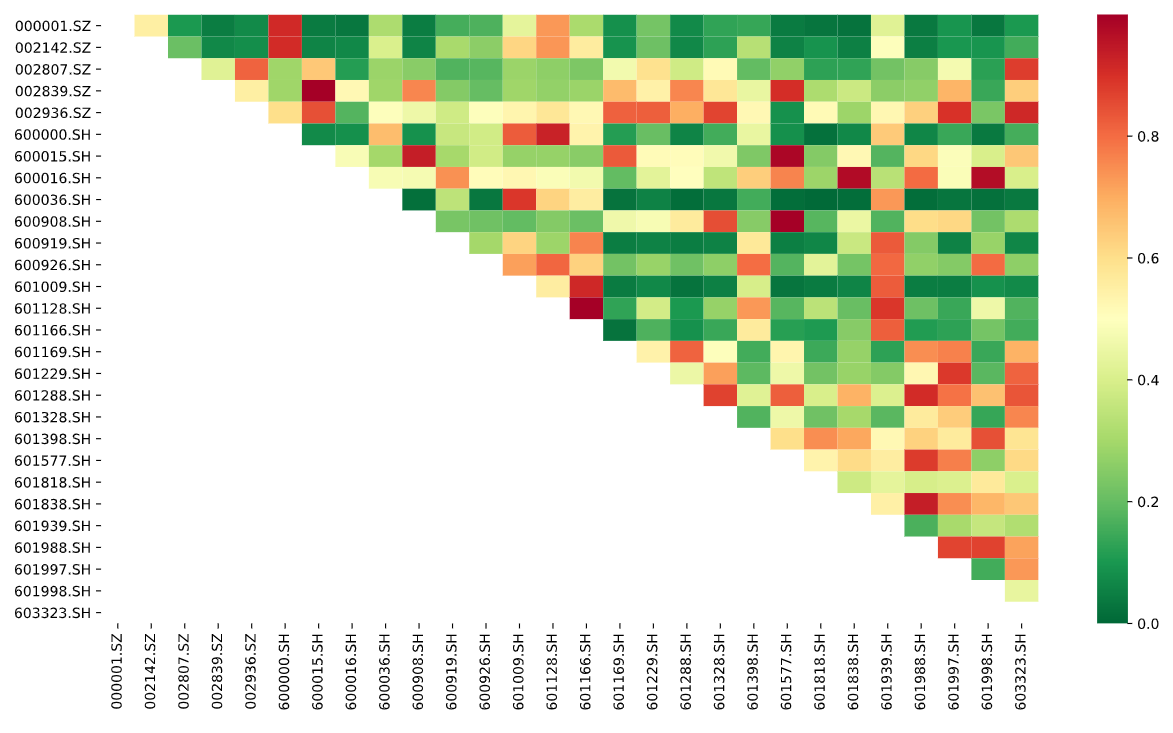

%matplotlib inline

plt.rcParams['figure.figsize'] = [15, 8]

sns.heatmap(1-pvalues, xticklabels=instruments_code, yticklabels=instruments_code, cmap='RdYlGn_r', mask = (pvalues == 1))

股票对的相关性热度图:

热度图中越红表示相关性越高,表示p值越小

pairs_df是下面这个表格显示:

| bank1 | bank2 | pvalue |

|---|---|---|

| 601128.SH | 601166.SH | 0.000734 |

| 600908.SH | 601577.SH | 0.002515 |

| 002839.SZ | 600015.SH | 0.002777 |

| 600015.SH | 601577.SH | 0.012600 |

| 600016.SH | 601838.SH | 0.027678 |

| 600016.SH | 601998.SH | 0.030310 |

可以看到601128.SH 和601166.SH 相关性最高,他们是

- 601128.SH 常熟银行 X

- 601166.SH 兴业银行 Y

# bank_choose = ['601128.SH','601166.SH']

bank_choose = [pairs_df.iloc[0].bank1,pairs_df.iloc[0].bank2]

# bank_choose

x = price_dict[bank_choose[0]]

y = price_dict[bank_choose[1]]

X = sm.add_constant(x)

result = (sm.OLS(y,X)).fit()

print(result.summary())

OLS Regression Results

==============================================================================

Dep. Variable: close R-squared: 0.853

Model: OLS Adj. R-squared: 0.852

Method: Least Squares F-statistic: 1415.

Date: Fri, 20 Mar 2020 Prob (F-statistic): 1.51e-103

Time: 22:43:54 Log-Likelihood: -160.79

No. Observations: 246 AIC: 325.6

Df Residuals: 244 BIC: 332.6

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 6.1175 0.324 18.883 0.000 5.479 6.756

close 1.5575 0.041 37.617 0.000 1.476 1.639

==============================================================================

Omnibus: 9.358 Durbin-Watson: 0.324

Prob(Omnibus): 0.009 Jarque-Bera (JB): 9.387

Skew: 0.468 Prob(JB): 0.00915

Kurtosis: 3.199 Cond. No. 86.5

==============================================================================

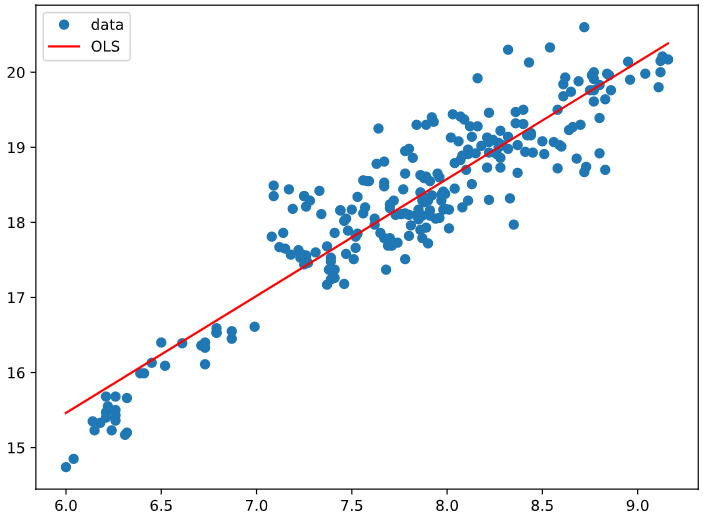

可以看到OLS线性回归之后,算出它们是以什么系数线性组合的系数构成平稳序列的。

Y = 1.5575*X + 6.1175

画出数据和拟合线:

fig, ax = plt.subplots(figsize=(8,6))

ax.plot(x, y, 'o', label="data")

ax.plot(x, result.fittedvalues, 'r', label="OLS")

ax.legend(loc='best')

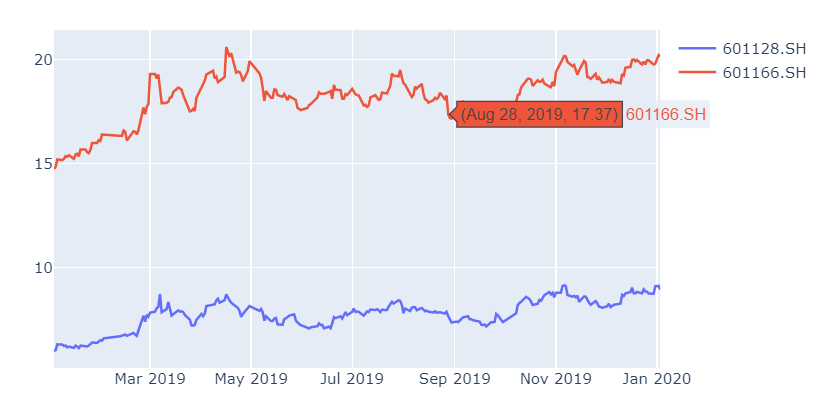

后面我想观察一下601128.SH 常熟银行 X 和601166.SH 兴业银行 Y是否真的相关,历史行情看一下走势,为此封装了一下plotly.graph_objects的函数:

def plot_scatter(fig, y, x=None, name=None, title=None, show=True):

fig.add_trace(go.Scatter(y=y, x=x, name=name))

fig.update_layout(title=title)

if show:

fig.show()

这里[::-1]都是为了把dataframe或者list倒过来,因为tushare获得的数据都是从最近的日期排下来的,譬如我这里20200103是index为0的数据,所以这里我为了画图倒过来了。

trade_date = prices_temp['trade_date'].unique()

date_series = pd.to_datetime(trade_date[::-1])

date_series

fig = go.Figure()

plot_scatter(fig, y=price_dict[bank_choose[0]][::-1], x=date_series, name=bank_choose[0], show=False)

plot_scatter(fig, y=price_dict[bank_choose[1]][::-1], x=date_series, name=bank_choose[1], show=True)

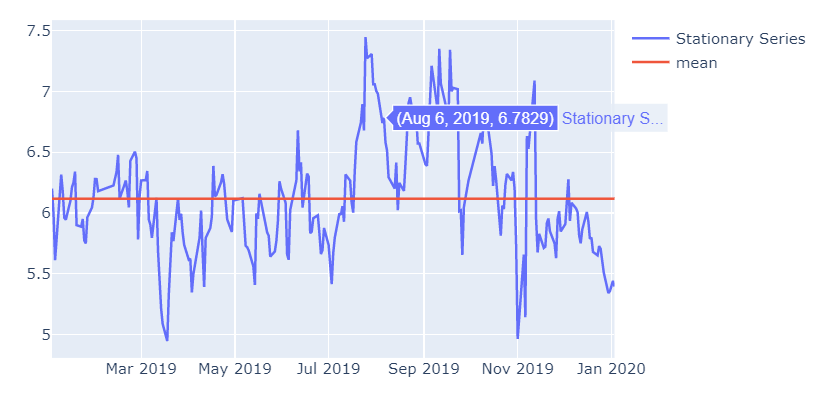

fig = go.Figure()

plot_scatter(fig, y=y-1.5575*x, x=date_series, name='Stationary Series', show=False)

plot_scatter(fig, y=[np.mean(y-1.5575*x)]*len(y), x=date_series, name='mean', show=True)

买卖时机的判断

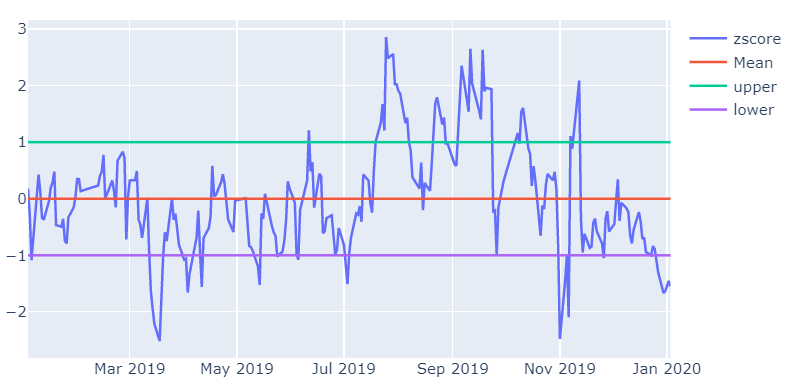

这里,我们先介绍一下, z−score 是对时间序列偏离其均值程度的衡量,表示时间序列偏离了其均值多少倍的标准差。首先,我们定义一个函数来计算 z−score:

一个序列在时间 t 的 z−score,是它在时间 t 的值,减去序列的均值,再除以序列的标准差后得到的值。

def zscore(series):

return (series - series.mean()) / np.std(series)

zscore_calcu = zscore(y-1.5575*x)

fig_bs=go.Figure()

plot_scatter(fig_bs,zscore_calcu,date_series,name='zscore',show=False)

plot_scatter(fig_bs,[0.]*len(y),date_series,name='Mean',show=False) # np.mean(zscore_calcu)=0.

plot_scatter(fig_bs,[1.]*len(y),date_series,name='upper',show=False)

plot_scatter(fig_bs,[-1.]*len(y),date_series,name='lower',show=True)

其实很简单的策略,就是当zscore大于1的时候我们认为Y的估值相对X已经过高,考虑卖出Y买入X,当小于-1的时候相反。

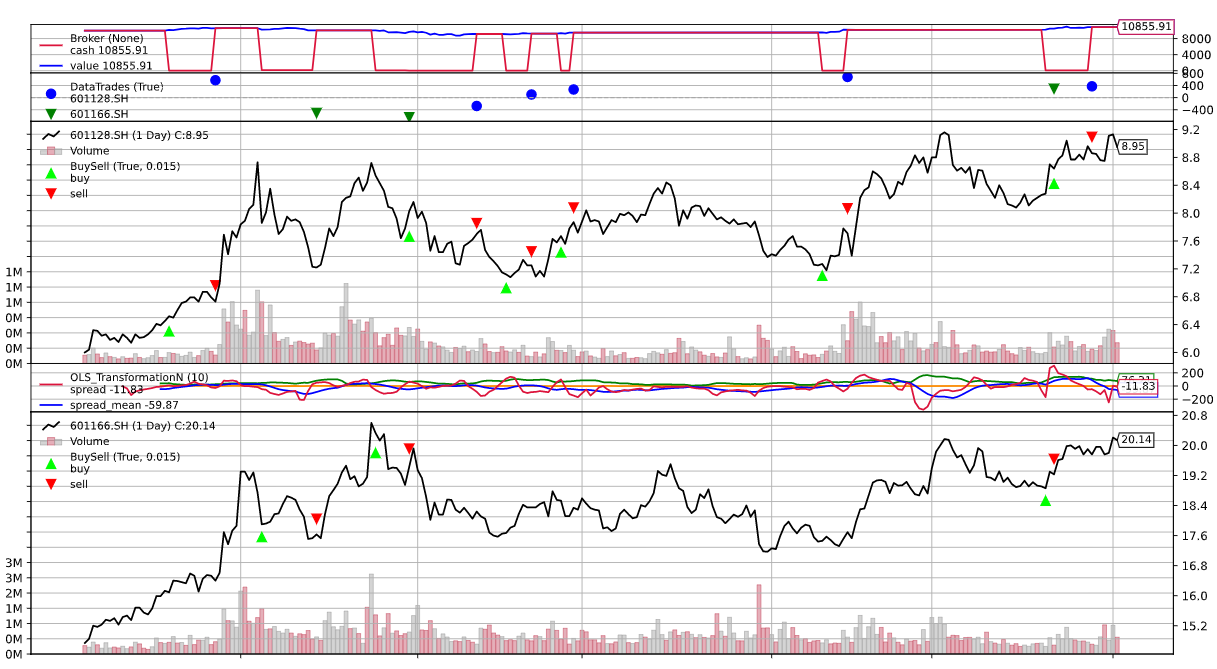

backtrader策略实现

1.交易标的:601128.SH 常熟银行 X和601166.SH 兴业银行 Y

2.交易信号: 当zscore大于1时,全仓买入data0常熟银行,全仓卖出data1兴业银行→做空价差 当zscore小于-1时,全仓卖出data0常熟银行,全仓买入data1兴业银行→做多价差

策略如下,写完策略可以直接传递给runner:

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

class PairTradingStrategy(bt.Strategy):

params = dict(

period=10,

qty1=0,

qty2=0,

printout=False,

upper=1,

lower=-1,

up_medium=0.5,

low_medium=-0.5,

status=0,

)

# 这里说明一下;self.p.upper即可访问params里的参数,这是bt.Strategy里实现的

# 所以这里params一般都是声明跟策略相关的变量,可以通过self.p的属性进行获取

def log(self, txt, dt=None):

if self.p.printout:

dt = dt or self.data.datetime[0]

dt = bt.num2date(dt)

def notify_order(self, order):

if order.status in [bt.Order.Submitted, bt.Order.Accepted]:

return # Await further notifications

if order.status == order.Completed:

if order.isbuy():

buytxt = 'BUY COMPLETE, %.2f' % order.executed.price

self.log(buytxt, order.executed.dt)

else:

selltxt = 'SELL COMPLETE, %.2f' % order.executed.price

self.log(selltxt, order.executed.dt)

elif order.status in [order.Expired, order.Canceled, order.Margin]:

self.log('%s ,' % order.Status[order.status])

pass # Simply log

# Allow new orders

self.orderid = None

def __init__(self):

# To control operation entries

self.orderid = None

self.qty1 = self.p.qty1

self.qty2 = self.p.qty2

self.upper_limit = self.p.upper

self.lower_limit = self.p.lower

self.up_medium = self.p.up_medium

self.low_medium = self.p.low_medium

self.status = self.p.status

# Signals performed with PD.OLS :

self.transform = btind.OLS_TransformationN(self.data0, self.data1,

period=self.p.period)

self.zscore = self.transform.zscore

def next(self):

if self.orderid:

return # if an order is active, no new orders are allowed

if self.p.printout:

print('Self len:', len(self))

print('Data0 len:', len(self.data0))

print('Data1 len:', len(self.data1))

print('Data0 len == Data1 len:',

len(self.data0) == len(self.data1))

print('Data0 dt:', self.data0.datetime.datetime())

print('Data1 dt:', self.data1.datetime.datetime())

print('status is', self.status)

print('zscore is', self.zscore[0])

if (self.zscore[0] > self.upper_limit) and (self.status != 1):

self.status = 1

self.order_target_percent(self.data1,0) # data1 = y

self.order_target_percent(self.data0,1) # data0 = x

elif (self.zscore[0] < self.lower_limit) and (self.status != 2):

self.order_target_percent(self.data0,0) # data0 = x

self.order_target_percent(self.data1,1) # data1 = y

self.status = 2

def stop(self):

print('==================================================')

print('Starting Value - %.2f' % self.broker.startingcash)

print('Ending Value - %.2f' % self.broker.getvalue())

print('==================================================')

根据之前写过的策略,我封装了一个Strategy_runner,后面继承为多数据策略的runner,这里不看也不妨碍理解:

from datetime import datetime

import backtrader as bt

import pandas as pd

import os

import tushare as ts

import matplotlib

import matplotlib.pyplot as plt

from stock_api import get_daily

matplotlib.use('agg')

data_path = './data/'

if not os.path.exists(data_path):

os.makedirs(data_path)

mytoken = 'your_token'

class Strategy_runner:

def __init__(self,

strategy,

ts_code,

start_date,

end_date,

data_path=data_path,

pro=True,

token=mytoken):

ts.set_token(mytoken)

pro = ts.pro_api()

self.ts_code = ts_code

self.start_date = start_date

self.end_date = end_date

self.data_path = data_path

# convert to datetime

self.start_datetime = datetime.strptime(start_date, '%Y%m%d')

self.end_datetime = datetime.strptime(end_date, '%Y%m%d')

df = self.read_save(self.ts_code, pro)

self.df_bt = self.preprocess(df, pro)

self.strategy = strategy

self.cerebro = bt.Cerebro()

def read_save(self, ts_code, pro=True):

if pro:

csv_name = f'pro_day_{str(ts_code)}-{str(self.start_date)}-{str(self.end_date)}.csv'

else:

csv_name = f'day_{str(ts_code)}-{str(self.start_date)}-{str(self.end_date)}.csv'

csv_path = os.path.join(self.data_path, csv_name)

if os.path.exists(csv_path):

if pro:

df = pd.read_csv(csv_path)

else:

df = pd.read_csv(csv_path, index_col=0)

else:

if pro:

# self.pro = ts.pro_api()

# self.df = self.pro.daily(ts_code=self.ts_code, start_date=self.start_date, end_date=self.end_date)

df = get_daily(ts_code, self.start_date, self.end_date)

if not df.empty:

df.to_csv(csv_path, index=False)

else:

df = ts.get_hist_data(ts_code, str(self.start_datetime),

str(self.end_datetime))

if not df.empty:

df.to_csv(csv_path, index=True)

return df

def preprocess(self, df, pro=False):

if pro:

features = ['open', 'high', 'low', 'close', 'vol', 'trade_date']

# convert_datetime = lambda x:datetime.strptime(x,'%Y%m%d')

convert_datetime = lambda x: pd.to_datetime(str(x))

df['trade_date'] = df['trade_date'].apply(convert_datetime)

bt_col_dict = {'vol': 'volume', 'trade_date': 'datetime'}

df = df.rename(columns=bt_col_dict)

df = df.set_index('datetime')

# df.index = pd.DatetimeIndex(df.index)

else:

features = ['open', 'high', 'low', 'close', 'volume']

df = df[features]

df['openinterest'] = 0

df.index = pd.DatetimeIndex(df.index)

df = df[::-1]

return df

def run(self):

data = bt.feeds.PandasData(dataname=self.df_bt,

fromdate=self.start_datetime,

todate=self.end_datetime)

self.cerebro.adddata(data) # Add the data feed

self.cerebro.addstrategy(self.strategy) # Add the trading strategy

# self.cerebro.broker.setcash(1000.0)

# self.cerebro.addsizer(bt.sizers.FixedSize, stake=100)

self.cerebro.broker.setcommission(commission=0.0) # 佣金

self.cerebro.addanalyzer(bt.analyzers.SharpeRatio, _name='SharpeRatio')

self.cerebro.addanalyzer(bt.analyzers.DrawDown, _name='DW')

self.results = self.cerebro.run()

strat = self.results[0]

print('Final Portfolio Value: %.2f' % self.cerebro.broker.getvalue())

print('SR:', strat.analyzers.SharpeRatio.get_analysis())

print('DW:', strat.analyzers.DW.get_analysis())

return self.cerebro, strat

def plot(self, iplot=False):

plt.rcParams['figure.figsize'] = [15, 8]

self.cerebro.plot(iplot=iplot)

def test():

from SmaCross import SmaCross

ts_code = '600515.SH'

start_date = '20190101'

end_date = '20191231'

strategy_runner = Strategy_runner(strategy=SmaCross,

ts_code=ts_code,

start_date=start_date,

end_date=end_date,

pro=True)

results = strategy_runner.run()

strategy_runner.plot()

return results

if __name__ == '__main__':

test()

继承封装为其投入多条股票数据,主要就是多一个ts_code1:

from Strategy_runner import Strategy_runner

data_path = './data/'

if not os.path.exists(data_path):

os.makedirs(data_path)

mytoken = 'your_token'

class Multidata_Strategy_runner(Strategy_runner):

def __init__(self, strategy, ts_code, ts_code1, start_date, end_date, data_path=data_path, pro=True, token=mytoken):

super().__init__(strategy, ts_code, start_date, end_date, data_path=data_path, pro=True, token=mytoken)

self.ts_code1 = ts_code1

df1 = super().read_save(self.ts_code1, pro)

self.df_bt1 = super().preprocess(df1, pro)

def run(self):

data = bt.feeds.PandasData(dataname=self.df_bt,

fromdate=self.start_datetime,

todate=self.end_datetime)

data1 = bt.feeds.PandasData(dataname=self.df_bt1,

fromdate=self.start_datetime,

todate=self.end_datetime)

self.cerebro.adddata(data, name=self.ts_code) # Add the data feed

self.cerebro.adddata(data1, name=self.ts_code1) # Add the data feed

self.cerebro.addstrategy(self.strategy) # Add the trading strategy

# self.cerebro.broker.setcash(1000.0)

# self.cerebro.addsizer(bt.sizers.FixedSize, stake=100)

self.cerebro.broker.setcommission(commission=0.0) # 佣金

self.cerebro.addanalyzer(bt.analyzers.SharpeRatio, _name='SharpeRatio')

self.cerebro.addanalyzer(bt.analyzers.DrawDown, _name='DW')

self.results = self.cerebro.run()

strat = self.results[0]

print('Final Portfolio Value: %.2f' % self.cerebro.broker.getvalue())

print('SR:', strat.analyzers.SharpeRatio.get_analysis())

print('DW:', strat.analyzers.DW.get_analysis())

return self.cerebro, strat

run一下:

strategy_runner = Multidata_Strategy_runner(strategy=PairTradingStrategy, ts_code=bank_choose[0], ts_code1=bank_choose[1],start_date=start_date, end_date=end_date, pro=True)

cerebro, strat = strategy_runner.run()

strategy_runner.plot()

==================================================

Starting Value - 10000.00

Ending Value - 10855.91

==================================================

Final Portfolio Value: 10855.91

SR: OrderedDict([('sharperatio', 0.7663305721395932)])

DW: AutoOrderedDict([('len', 12), ('drawdown', 0.9858628237869406), ('moneydown', 108.09000000000015), ('max', AutoOrderedDict([('len', 202), ('drawdown', 18.257629657367524), ('moneydown', 1950.2799999999988)]))])

最后赚了855.91元。

总结

实现过程并不难,主要是为了分析这个策略的可行性,理解其思想,首先配对交易的假设是未来走势也与现在分析的存在较高相关性,但是是否真是如此,如果后面走势不一致,以及价值不符合市场,暴跌暴升是否能预测出呢?

完整的代码可以看我的github repo: