Risks for hedge funds

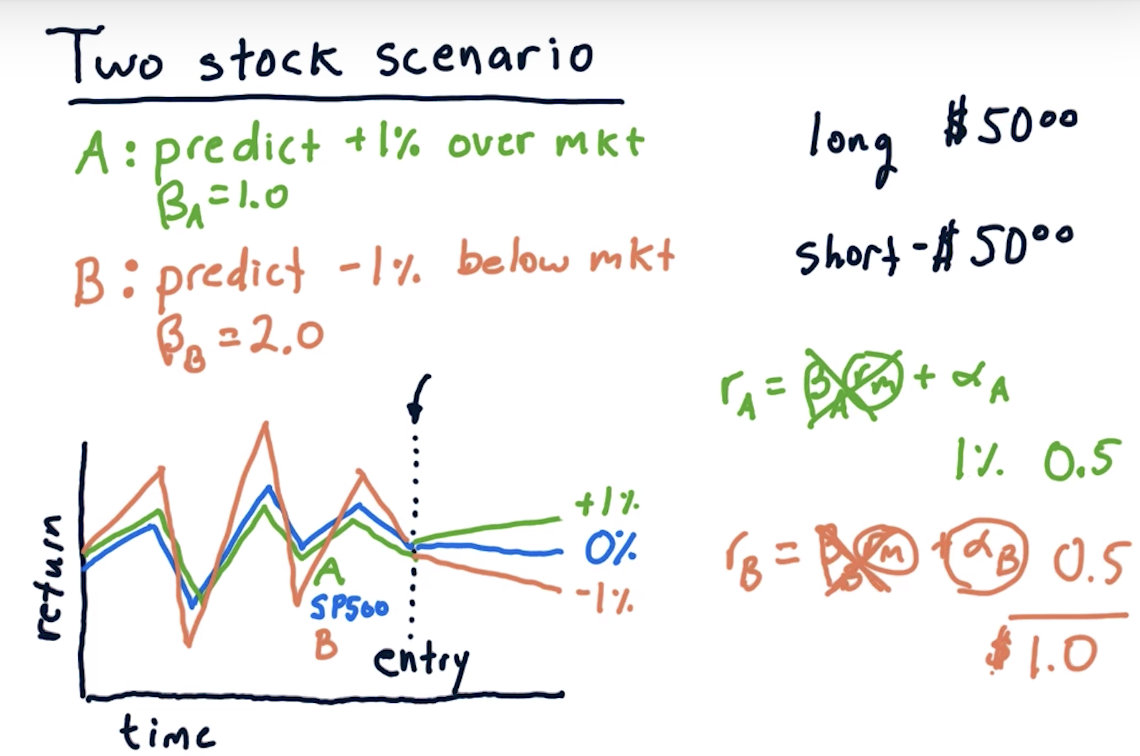

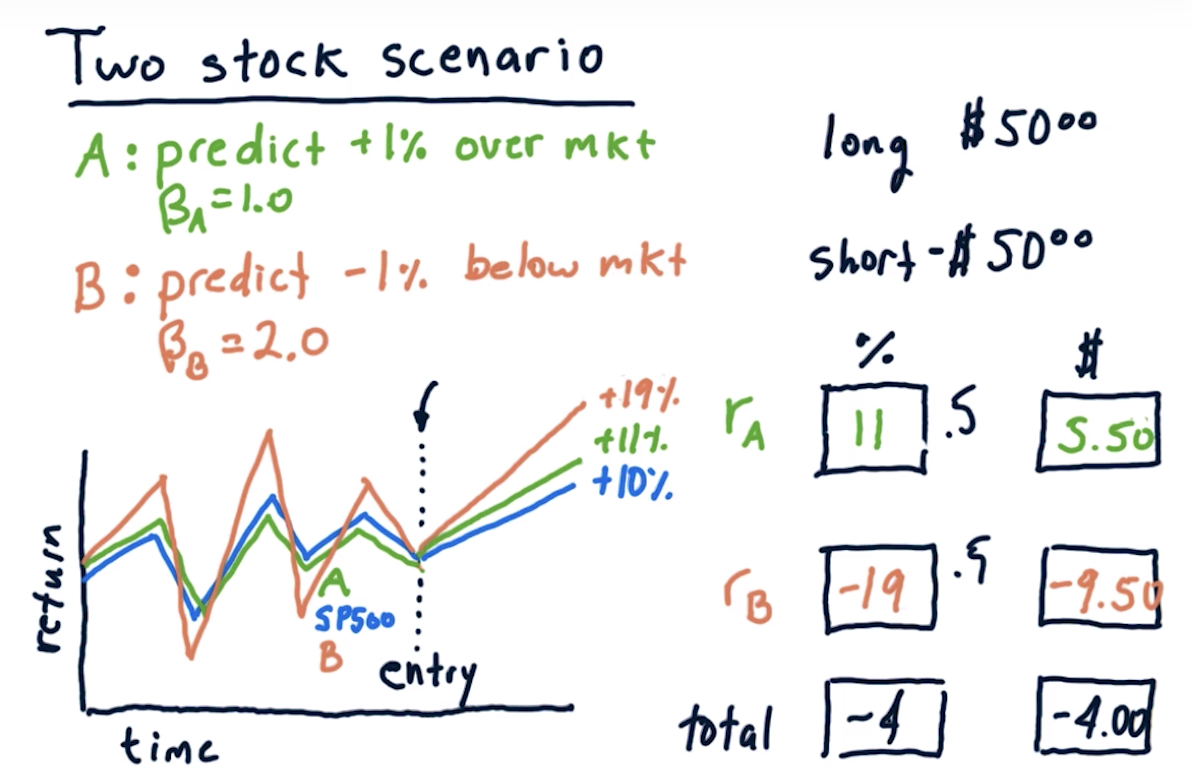

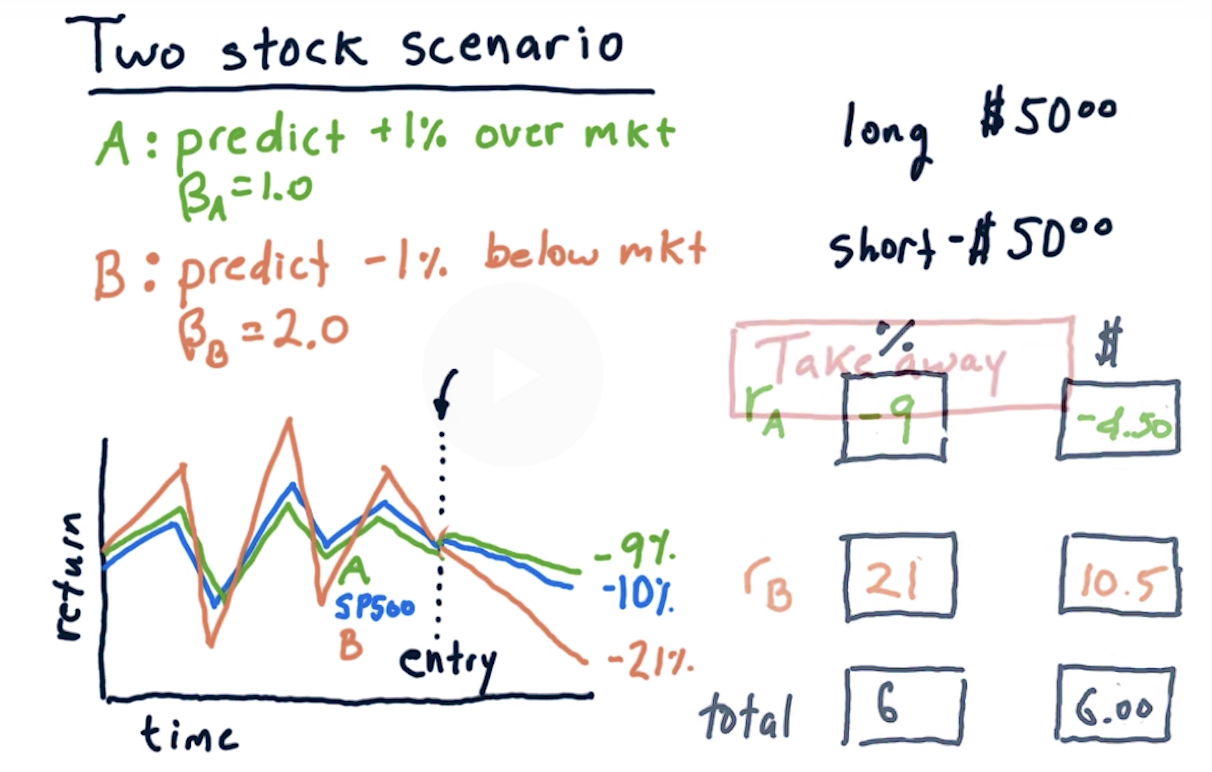

Two stock scenario

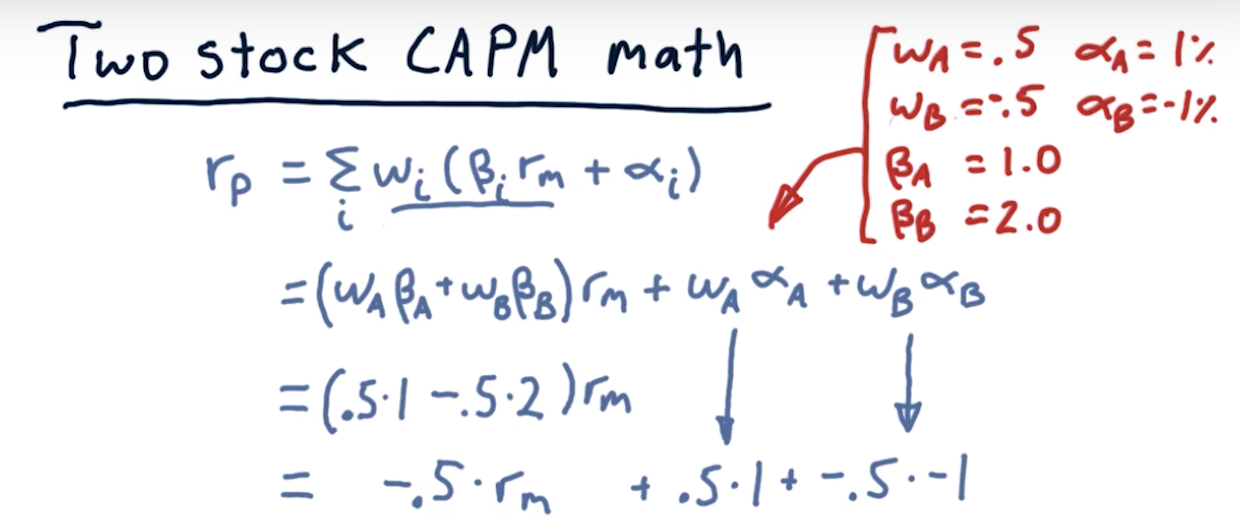

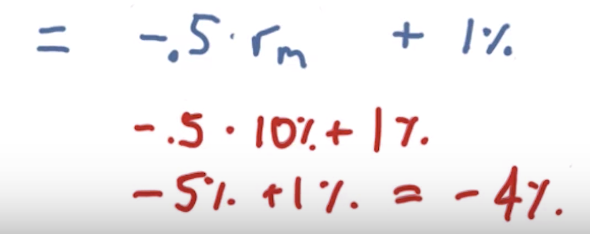

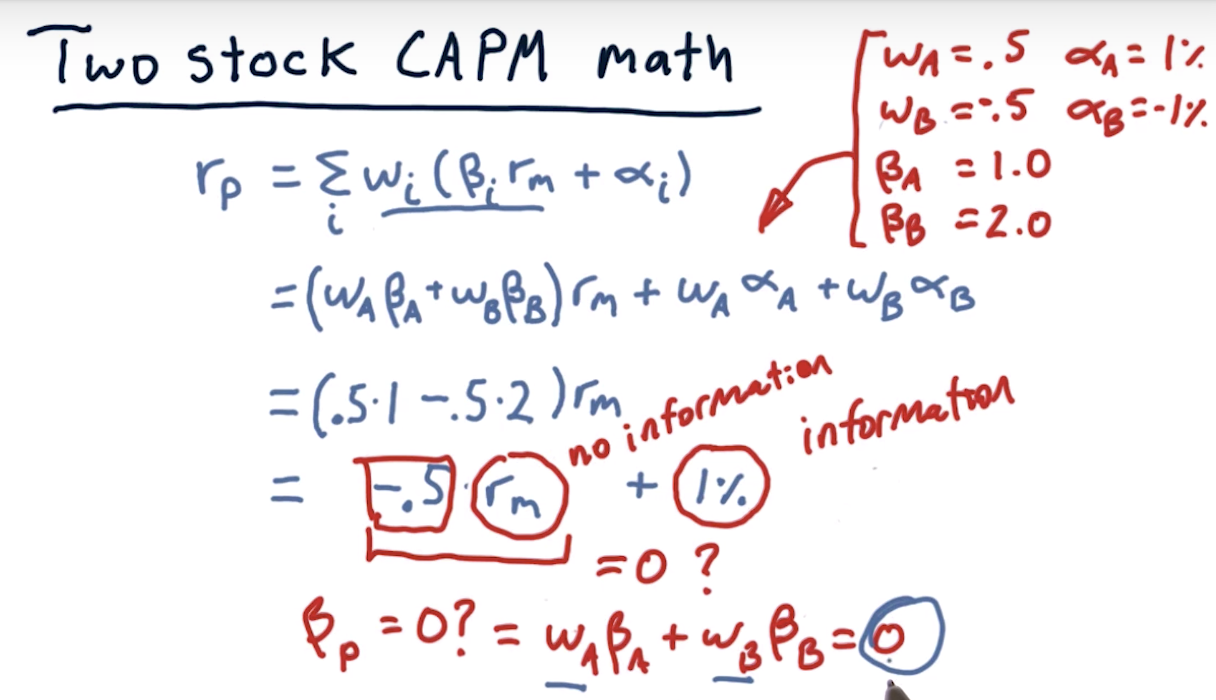

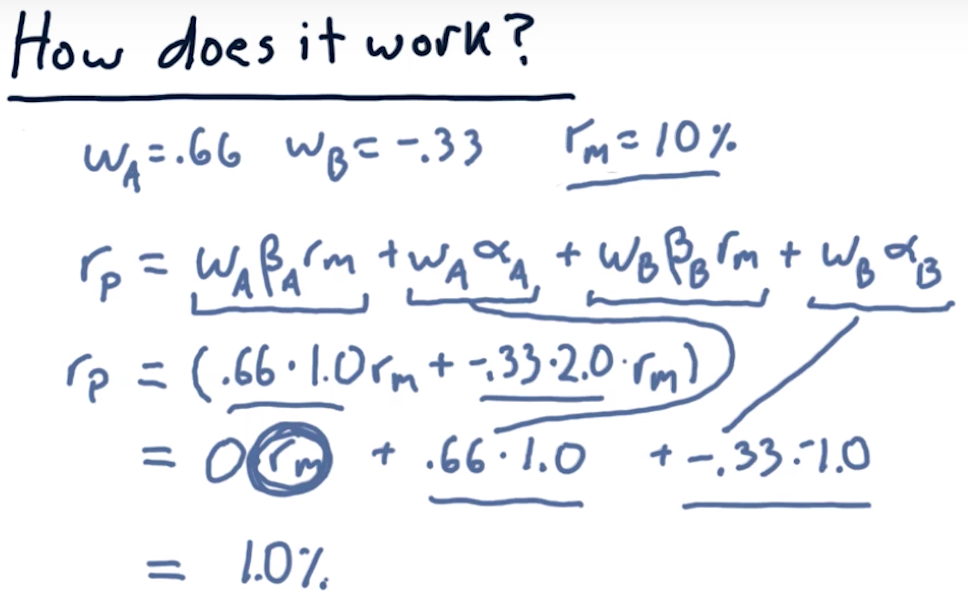

Two stock CAPM math

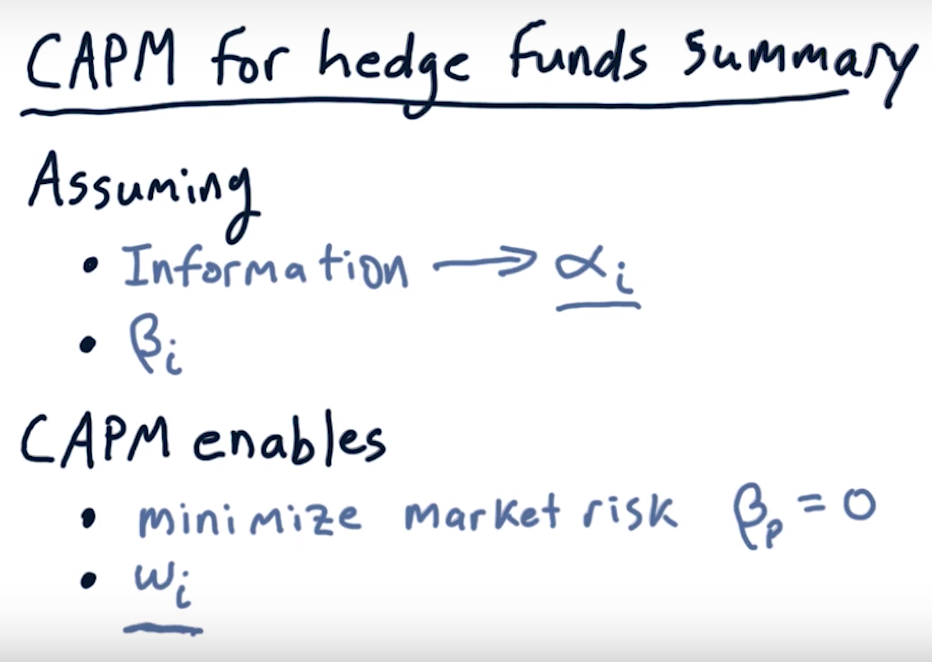

how to remove the incluence of the market or beta???

Allocations remove market risk

How does it work?

CAPM for hedge funds summary

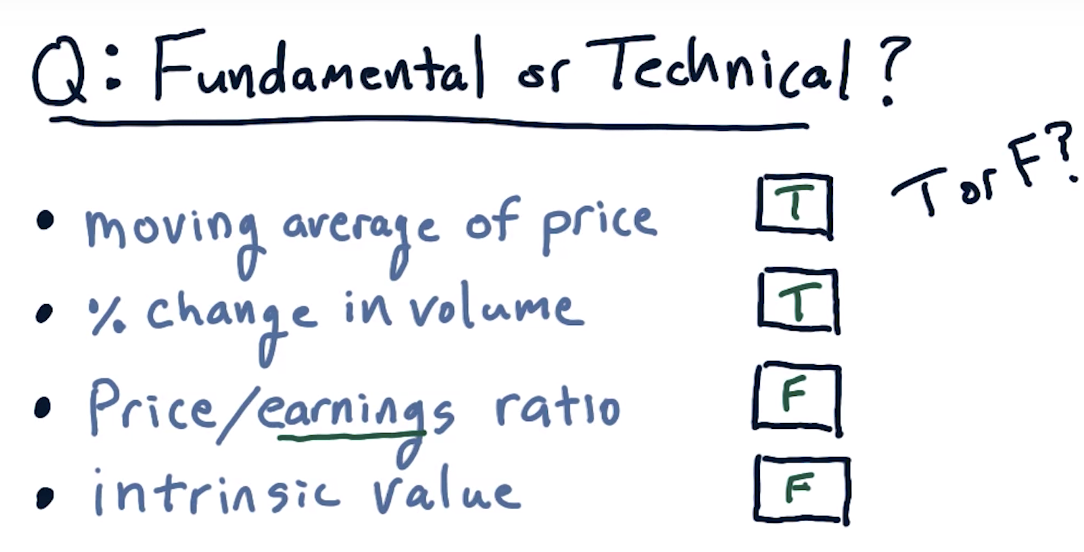

two broad categories of approaches to use for choosing stocks to buy or sell => (1) Technical vs. (2) fundamental analysis

(1) Technical analysis => doesnt care about the value of a company => looking for patterns or trends in a tock's price

(2) Fundamental analysis => looking at aspects of a company in order to estimate its value, looking for the situations where the price of a company is below its value

Characteristics

Potential indicators

earning is a fundamental factor => P/E ratio is F

intrinsic value => based on dividends => F

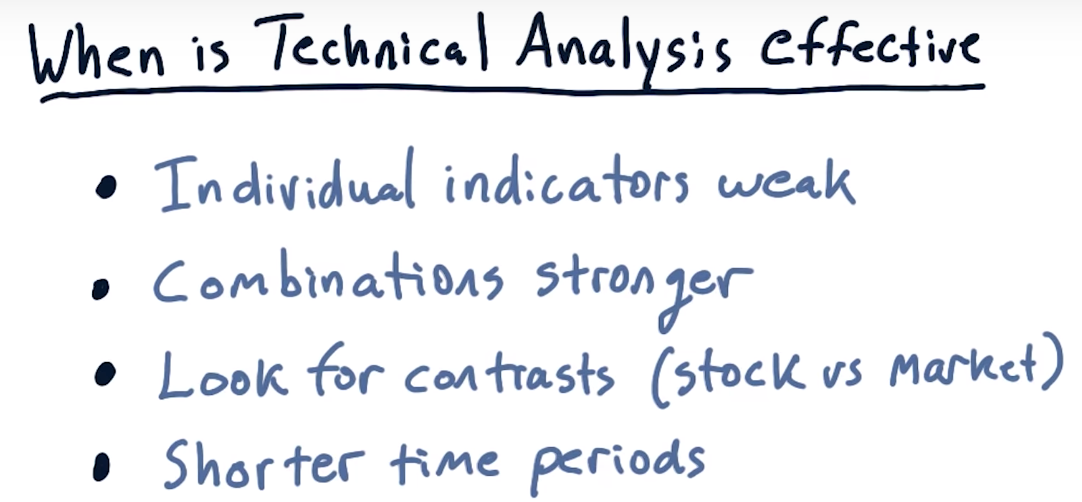

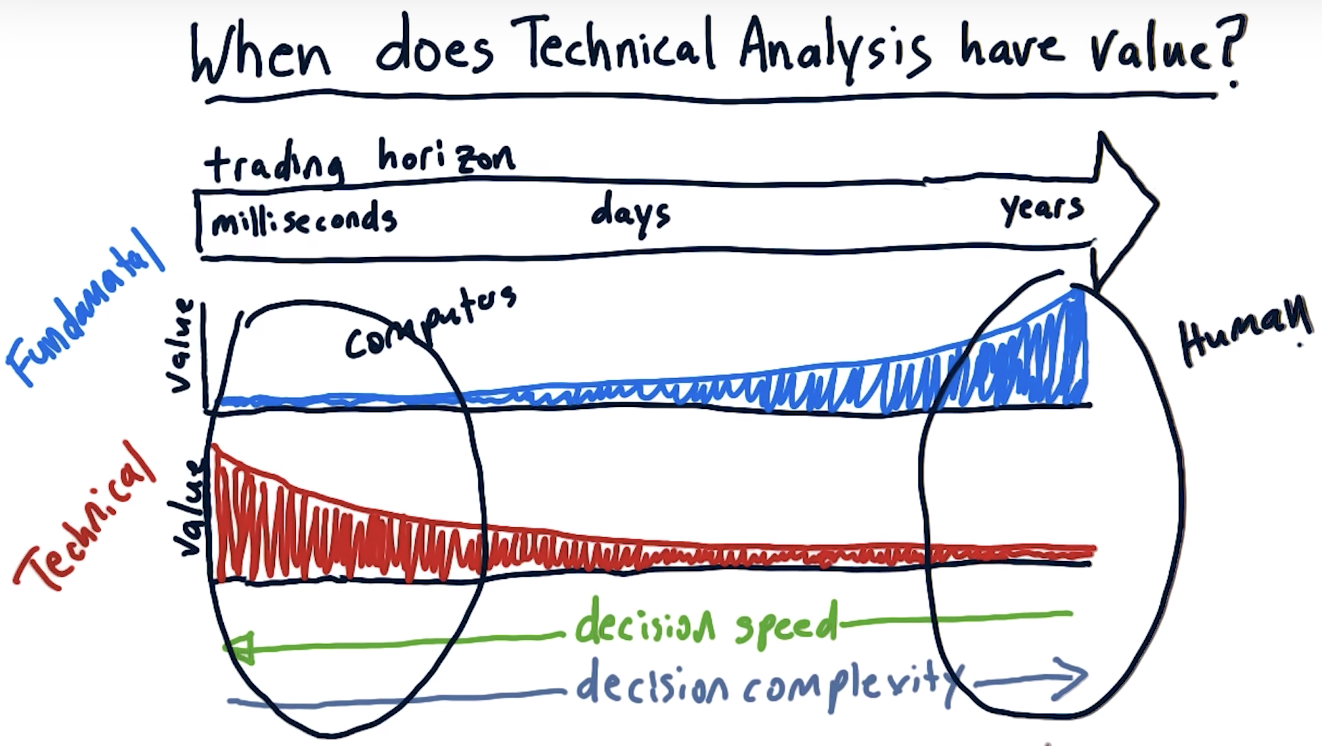

When is technical analysis valuable?

When is technical analysis valuable? (part 2)

consider where is the best region for human to operate and where is the best region for computers to operate

=> different types of hedge funds

ms => computer

day => mixture of human and computer

year => human

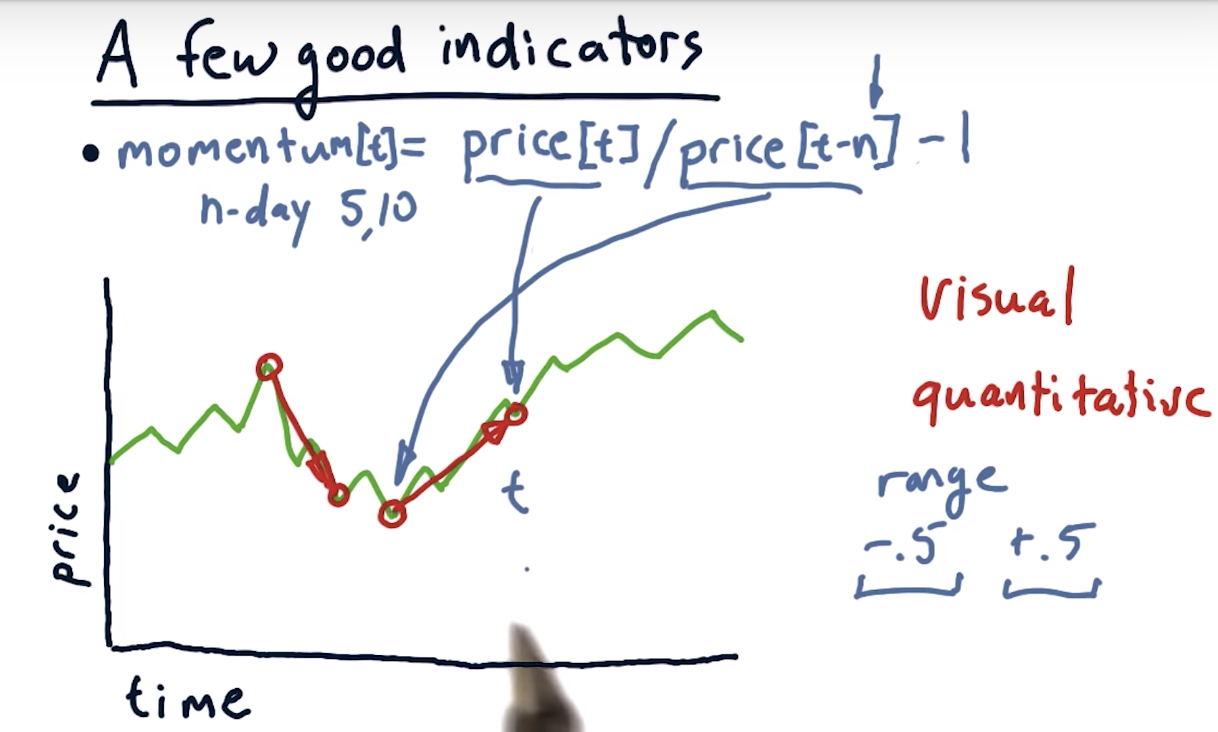

A few indicators: Momentum

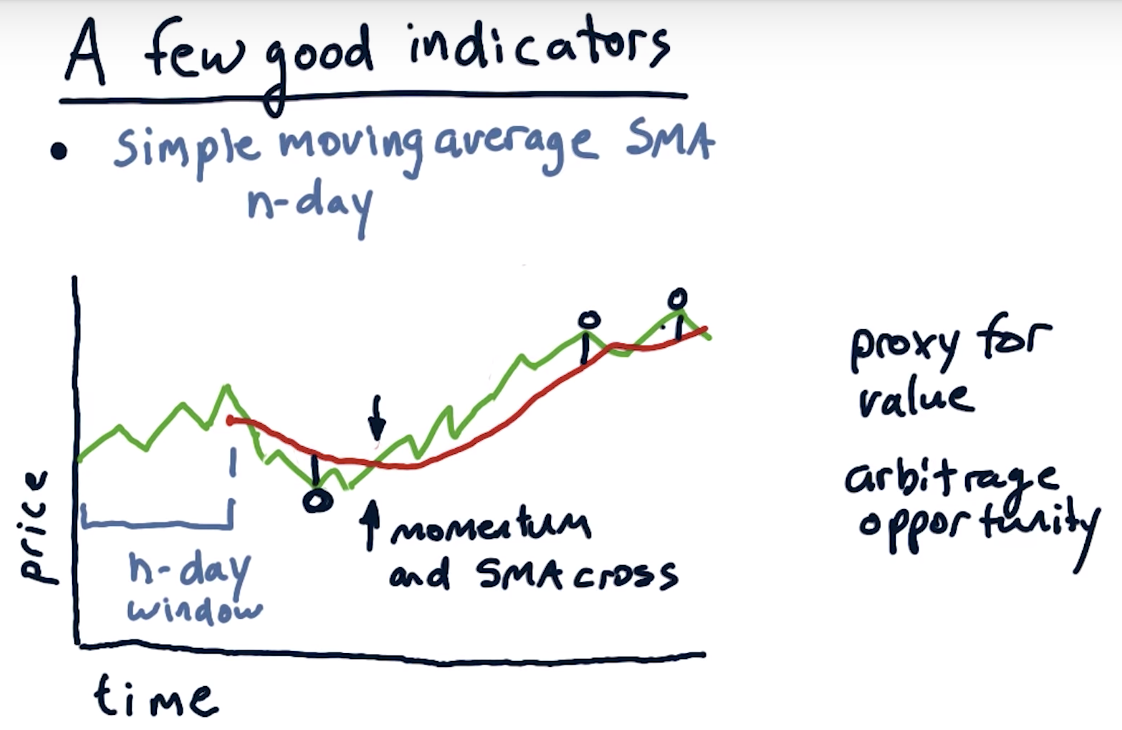

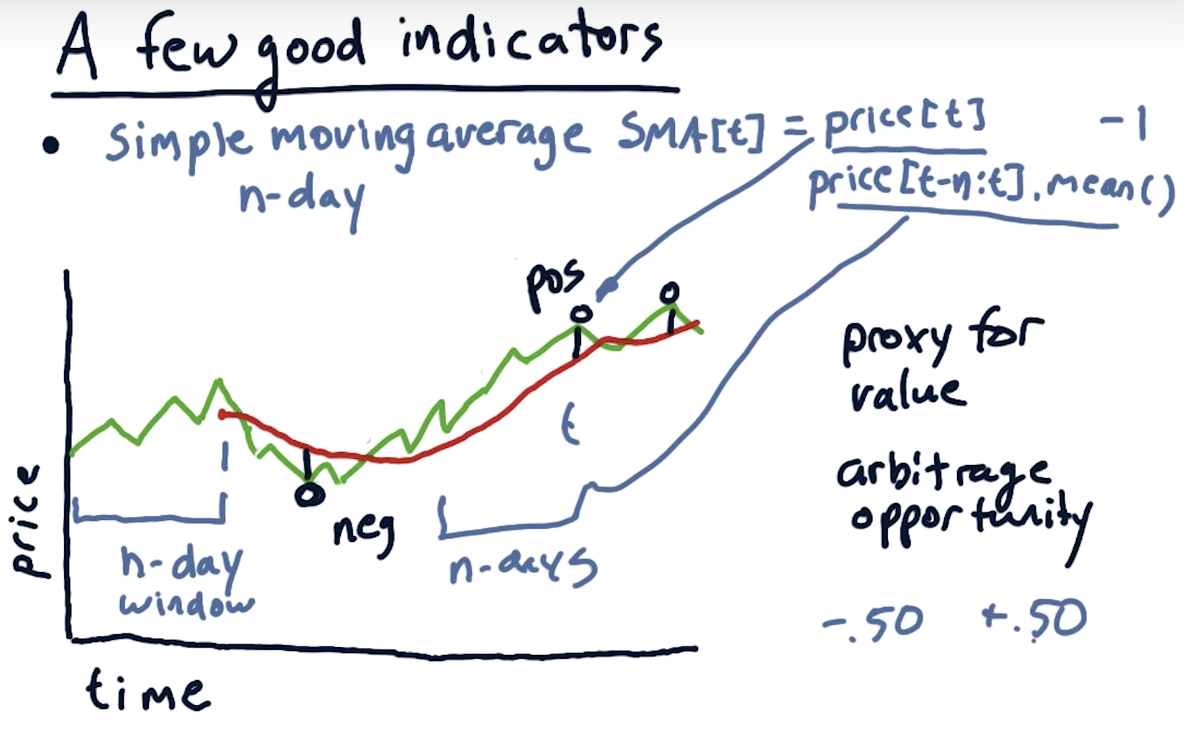

A few indicators: Simple moving average

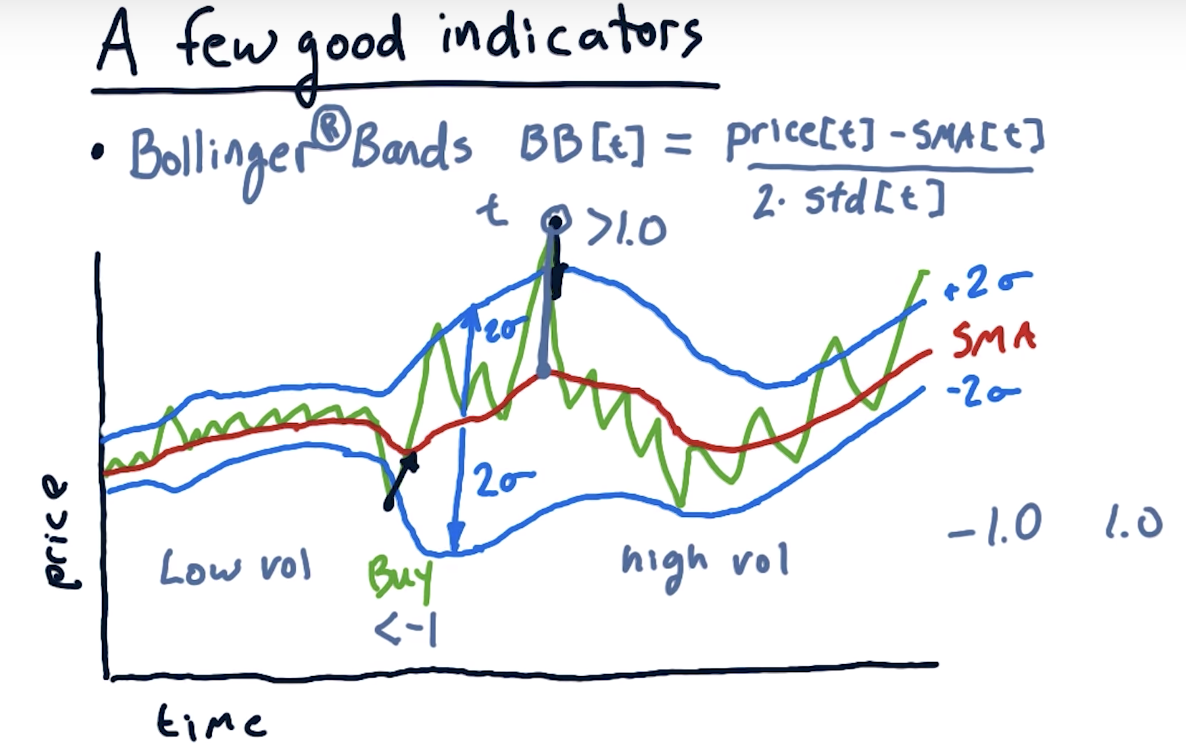

A few indicators: Bollinger Bands

Buy or sell?

for ②, it's unclear whether green curve will return or not, whereas for ③, situation is exactly opposite.

Normalization

Wrap up