Taxes can be one of the largest cash outflows that a firm experiences.The size of the tax bill(税单) is determined through the tax code(税则) and often-amended set of rules.

Notes:If the various rules of taxation seem a little bizarre(奇怪的) or convoluted(复杂的,费解的) to you,keep in mind that the tax code is the result of political,not economic,forces.

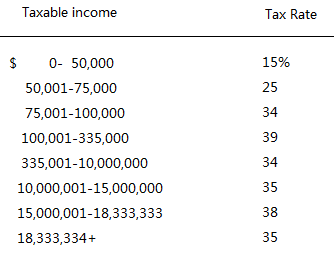

Corporate Tax Rates:not strictly increasing.Current tax rule:15,25,34,,35, and the 38,39 arise because of "surcharges" applied on top of the 34,35. So there are really six corporate tax brackets(税级).

- Average versus Marginal Tax rates:

Average tax rate(平均税率) is your tax bill divided by your taxable income,in other words,the percentage of income that goes to pay taxes.

Marginal tax rate (边际税率) is the extra tax you would pay if you earned one more dollar.(超额部分才交税)

There is another tax rate:flat-rate tax(固定税率),the marginal tax rate is always the same as the average tax rate.