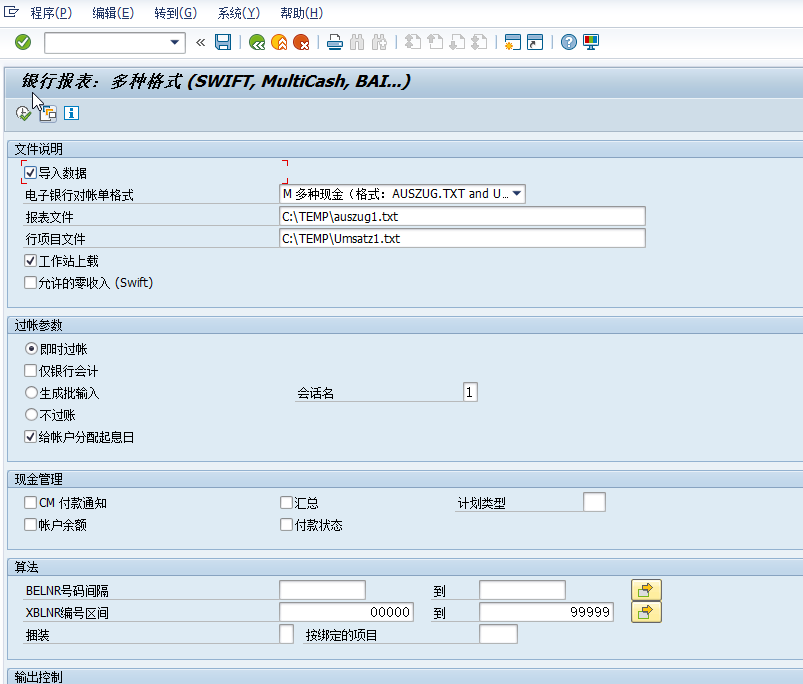

如果FF.5 银行接口服务器上文件 BANK STATEMENT 回单上传失败的话

- Balances(AUSZUG.TXT) - 余额文件

- Transactions(UMSATZ.TXT) - 明细文件

1. Create House Bank and Account ID (FI12)

2. Setup EDI Partner Profile for FINSTA Message Type (WE20)

3. Configure Global Settings for EBS (IMG)

- Create Account Symbols

- Assign Accounts to Account Symbols

- Create Keys for Posting Rules

- Define Posting Rules

- Create Transaction Types

- Assign External Transaction Types to Posting Rules

- Assign Bank Accounts to Transaction Types

4. Define Search String for EBS(Optional)

- Search String Definition

- Search String Use

5. Define Program and Variant Selection

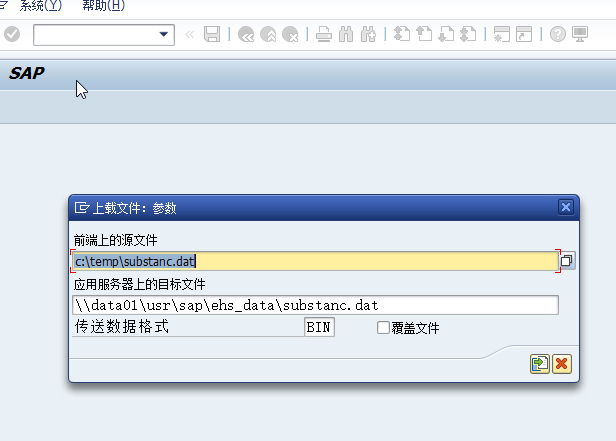

CG3Y 下载到本地

CFG3Z UPLOAD导入结果,

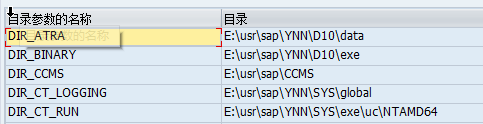

查询文件路径用AL11

NOTES: 36833 - Multicash Format (auszug.txt and umsatz.txt)

Multicash Format (auszug.txt and umsatz.txt)

Other Terms

RFEBKA00, FF.5, mulitcash, RFEKA200, bank statement, electronic

format description

Reason and Prerequisites

Solution

The files have to be ASCII-coded, no quotes.

The delimiter between the fields is the semicolon ';'.

Type description:

A - Alphanumeric

N - Numbers

X - Date in Fomat DD.MM.YY

(Example 25.01.94 for January 25th of 1994)

AUSZUG.TXT

----------

Field# Type min. max. opt. Description

1 A 0 12 bank key

2 A 0 24 bank account number

3 N 1 4 statement number

4 X 8 8 statement date

5 A 3 3 currency key

6 N 1 18.2 opening balance amount

7 N 1 18.2 debit total

8 N 1 18.2 credit total

9 N 1 18.2 closing balance amount

10 A 0 35 bank account holder

11 A 0 35 X special account name

12 X 8 8 X life start

13 X 8 8 X life end

14 0 0 not used

15 0 0 not used

16 0 0 not used

17 0 0 not used

18 N 1 5 number of records in statement

UMSATZ.TXT

==========

Field# Type min. max. opt. Description

1 A 0 12 bank key

2 A 0 24 bank account number

3 N 1 4 statement number

4 X 8 8 value date

5 N 1 10 X primary note number

6 A 0 27 X note to payee 1

7 A 0 27 X bank posting text

8 0 0 not used

9 A 0 4 X text key

10 A 0 16 X check number

11 N 1 18.2 amount

12 0 0 not used

13 0 0 not used

14 X 8 8 Posting Date

15 0 00 not used

16 0 00 not used

17 A 0 27 X note to payee 2

18 A 0 27 X note to payee 3

19 A 0 27 X note to payee 4

20 A 0 27 X note to payee 5

21 A 0 27 X note to payee 6

22 A 0 27 X note to payee 7

23 A 0 27 X note to payee 8

24 A 0 27 X note to payee 9

25 A 0 27 X note to payee 10

26 A 0 27 X note to payee 11

27 A 0 27 X note to payee 12

28 A 0 27 X note to payee 13

29 A 0 27 X note to payee 14

30 A 0 27 X business partner

31 A 0 27 X business partner

32 A 0 12 X bank key of the partner's bank

33 A 0 24 X bank account number of the partner

34 A 0 3 X business transaction code

35 0 0 not used

Changes if multicash-EURO is used: (See also note 109893)

36 A 3 3 currency key (OCMT)

37 N 1 18.2 amount (OCMT)

Field 34 ( business transaction code ) or field 9 ( text key ) are used as 'External business transaction code (EBTC)' in Table T028G.

If field 34 and field 9 are both empty then field 7 (bank posting text) is used as EBTC.

SAP Multicash statement format

The SAP Multicash format is comprised of two (2) export formats:

- Balances(AUSZUG.TXT)

- Transactions(UMSATZ.TXT)

Both the balance and transaction exports must be imported into your general ledger system. The exports are complimentary.

Format overview

Field delimiters

Each field in the SAP Multicash file is delimited with a semicolon (;).

Record termination

Each record is terminated by a CR/LF end-of-line pair.

Leading zeros

All leading zeros within file extracts will be provided, including the following leading zeros;

- Transaction Codes (e.g.

001,099etc). - Account Numbers (e.g.

032-000,000007,032000000016).

File specification

Balances

| # | Field Name | Field Description / Characteristics | Data Format (length) | Mandatory / Optional |

|---|---|---|---|---|

| 1 | Bank Key | Populated with the BSB of the current account. For Example 032-000 |

Alphanumeric (7) | Mandatory |

| 2 | Bank Account Number | Populated with the account number. For Example 136465 |

Numeric (6) | Mandatory |

| 3 | Statement Number | Statement Number is represented as a date formatted as YYNNN where NNN is the Julian date.For Example 17002 |

Numeric (5) | Mandatory |

| 4 | Statement Date | Statement Date formatted as DD.MM.YY |

Date (8) | Mandatory |

| 5 | Currency | Currency code will be represented as a valid ISO 4217 currency code. For Example AUD |

Alpha (3) | Mandatory |

| 6 | Opening Balance | Account Opening Balance. Signed amount formatted to 2 decimal places. For example: 13.41, -13.41 |

Numeric | Mandatory |

| 7 | Debit Total | Sum of all debit transactions for the current statement represented as an absolute value. | Numeric | Mandatory |

| 8 | Credit Total | Sum of all credit transactions for the current statement. | Numeric | Mandatory |

| 9 | Closing Balance | Account Closing Balance. Signed amount formatted to 2 decimal places. For example: 13.41, -13.41 |

Numeric | Mandatory |

| 10 | Bank Account Holder | Represents an alias for the current bank account. For example: Receivables Account |

Alphanumeric | Optional |

| 11 | Special Account Name | Intentionally left blank | Empty | Omitted |

| 12 | Life Start | Intentionally left blank | Empty | Omitted |

| 13 | Life End | Intentionally left blank | Empty | Omitted |

| 14 | Not Used | Intentionally left blank | Empty | Omitted |

| 15 | Not Used | Intentionally left blank | Empty | Omitted |

| 16 | Not Used | Intentionally left blank | Empty | Omitted |

| 17 | Not Used | Intentionally left blank | Empty | Omitted |

| 18 | Number of Records in Statement | Count of all transactions (Credit and Debit) for the current statement. | Number | Mandatory |

Transactions

| # | Field Name | Field Description / Characteristics | Data Format (length) | Mandatory / Optional |

|---|---|---|---|---|

| 1 | Bank Key | Populated with the BSB of the current account. For Example 032-000 |

Alphanumeric (7) | Mandatory |

| 2 | Bank Account Number | Populated with the account number. For Example 136465 |

Numeric (6) | Mandatory |

| 3 | Statement Number | Statement Number is represented as a date formatted as YYNNN where NNN is the Julian date.For Example 17002 |

Numeric (5) | Mandatory |

| 4 | Statement Date | Statement Date formatted as DD.MM.YY |

Date (8) | Mandatory |

| 5 | Primary Note Number | Intentionally left blank | Empty | Omitted |

| 6 | Note to Payee 1 | Contains the first 27 characters of the transaction narrative | Alphanumeric (27) | Optional |

| 7 | Bank Posting Text | Intentionally left blank | Empty | Omitted |

| 8 | Not Used | Intentionally left blank | Empty | Omitted |

| 9 | Text Key | Intentionally left blank | Empty | Omitted |

| 10 | Serial Number | Transaction serial code. For Cheque deposits this will contain the cheque number. | Alphanumeric (16) | Optional |

| 11 | Transaction Amount | Signed amount formatted to 2 decimal places. For example: 13.41, -13.41 |

Numeric | Mandatory |

| 12 | Not Used | Intentionally left blank | Empty | Omitted |

| 13 | Not Used | Intentionally left blank | Empty | Omitted |

| 14 | Posting Date | Intentionally left blank | Empty | Omitted |

| 15 | Not Used | Intentionally left blank | Empty | Omitted |

| 16 | Not Used | Intentionally left blank | Empty | Omitted |

| 17 | Note to Payee 2 | Contains the next 27 characters of the transaction narrative | Alphanumeric (27) | Optional |

| 18 | Note to Payee 3 | Contains the next 27 characters of the transaction narrative | Alphanumeric (27) | Optional |

| 19 | Note to Payee 4 | Contains the next 27 characters of the transaction narrative | Alphanumeric (27) | Optional |

| 20 | Note to Payee 5 | Contains the next 12 characters of the transaction narrative | Alphanumeric (12) | Optional |

| 21 | Note to Payee 6 | Contains the next 28 characters of the transaction narrative | Alphanumeric (28) | Optional |

| 22 | Note to Payee 7 | Contains the next 28 characters of the transaction narrative | Alphanumeric (28) | Optional |

| 23 | Note to Payee 8 | Contains the next 28 characters of the transaction narrative | Alphanumeric (28) | Optional |

| 24 | Note to Payee 9 | Intentionally left blank | Empty | Omitted |

| 25 | Note to Payee 10 | Intentionally left blank | Empty | Omitted |

| 26 | Note to Payee 11 | Intentionally left blank | Empty | Omitted |

| 27 | Note to Payee 12 | Intentionally left blank | Empty | Omitted |

| 28 | Note to Payee 13 | Intentionally left blank | Empty | Omitted |

| 29 | Note to Payee 14 | Intentionally left blank | Empty | Omitted |

| 30 | Business Partner | Intentionally left blank | Empty | Omitted |

| 31 | Business Partner | Intentionally left blank | Empty | Omitted |

| 32 | Bank Key of the Partner's Bank | Intentionally left blank | Empty | Omitted |

| 33 | Bank Account Number of the Partner | Intentionally left blank | Empty | Omitted |

| 34 | Business Transaction Code | A three digit transaction Westpac assigned transaction code | Alphanumeric (3) | Mandatory |

| 35 | Not Used | Intentionally left blank | Empty | Omitted |

| 36 | Not Used | Intentionally left blank | Empty | Omitted |

| 37 | Not Used | Intentionally left blank | Empty | Omitted |

Format variations

This file format represents the BankRec implementation of the SAP Multicash specification. As such, there may be minor differences between this file format and COL/WIBS-AI sourced statements.

Enrichment support

If you receive a data-enriched (bulked, reconciled, debulked or enriched) statement there will be some modifications to the Transaction file.

Bulked/Reconciled enrichment

For bulked and reconciled enrichment, the following modifications will be applied to the Transactions file:

Note to Payee 1: This field will be populated with thePayment Reference.Note to Payee 2: This field will be populated with a unique, BankRec-generated transaction identifier.

Note: All subsequent Note to Payee fields (3~14) will be empty.

Debulked recievables enrichment

For debulked recievables enrichment, the following modifications will be applied to the Transactions file:

- Each line that previously represented a bulk settlement record will be replaced with multiple lines that represent the individual payments that formed part of the bulk settlement.

Note to Payee 1: This field will be populated with theCustomer Reference Number.Note to Payee 2: This field will be populated with thePayment Reference.Note to Payee 3: This field will be populated with a unique, BankRec-generated transaction identifier.

Note: All subsequent Note to Payee fields (4~14) will be empty.

Debulked payables enrichment

For debulked payables enrichment, the following modifications will be applied to the Transactions file:

- Each line that previously represented a bulk settlement record will be replaced with multiple lines that represent the individual payments that formed part of the bulk settlement.

Note to Payee 1: This field will be populated with thePayer Reference.Note to Payee 2: This field will be populated with thePayee Reference.Note to Payee 3: This field will be populated with a unique, BankRec-generated transaction identifier.

Note: All subsequent Note to Payee fields (4~14) will be empty.

External entry enrichment

For external entry enrichment (i.e, transactions enriched with information from an external EFT feed), the following modifications will be applied to the Transactions file:

Note to Payee 1: This field will be populated with theCustomer Code.Note to Payee 2: This field will be populated with theRemitter Name.

Note: All subsequent Note to Payee fields (3~14) will be empty.

If you require further enrichment (transaction code manipulation, alternate reference values, etc.), you should discuss this during your implementation.

Sample files

The following files are intended to be examples only.

NPP sample transactions

Download the NPP sample SAP Multicash Transactions file.

This file contains examples of all NPP transaction codes, and how they will appear in a standard SAP Multicash Transactions statement.