![]()

![]()

![]()

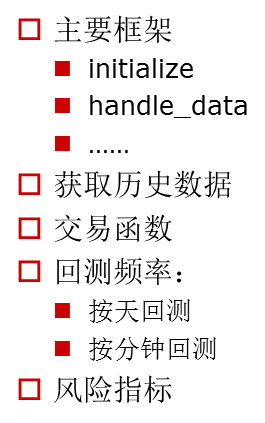

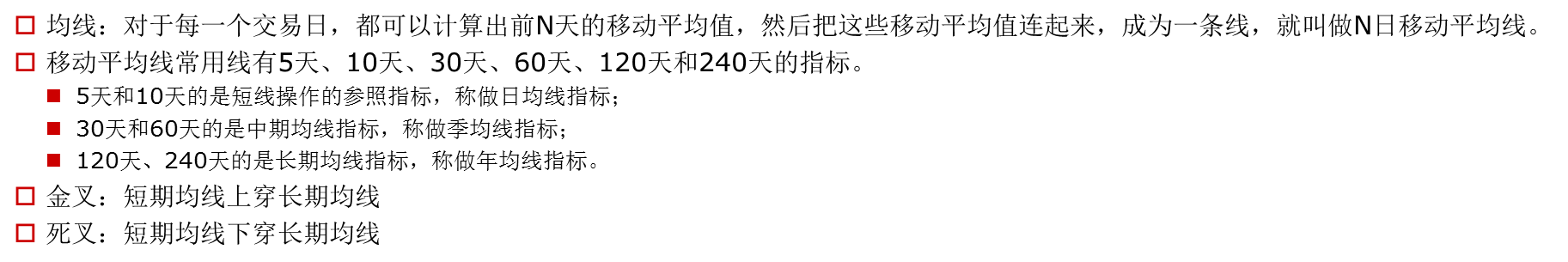

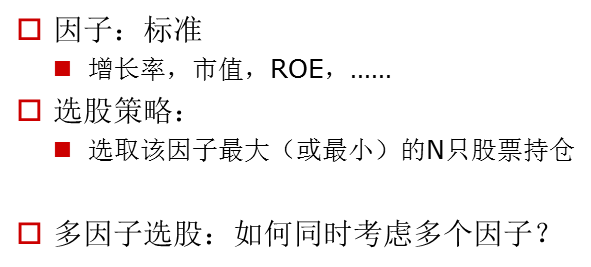

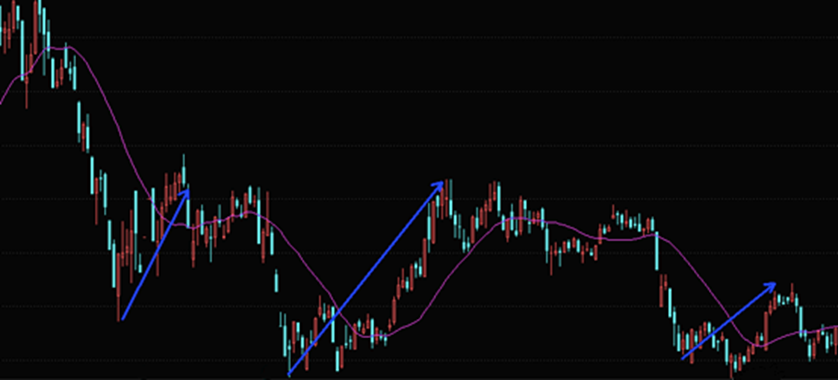

0. 第一个量化策略 # 初始化函数,设定基准等等 def initialize(context): set_benchmark('000300.XSHG') g.security = get_index_stocks('000300.XSHG') # 股票池 set_option('use_real_price', True) set_order_cost(OrderCost(open_tax=0, close_tax=0.001, open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock') log.set_level('order','warning') def handle_data(context, data): # 一般情况下先卖后买 tobuy = [] for stock in g.security: p = get_current_data()[stock].day_open amount = context.portfolio.positions[stock].total_amount cost = context.portfolio.positions[stock].avg_cost if amount > 0 and p >= cost * 1.25: order_target(stock, 0) # 止盈 if amount > 0 and p <= cost * 0.9: order_target(stock, 0) # 止损 if p <= 10.0 and amount == 0: tobuy.append(stock) if len(tobuy)>0: cash_per_stock = context.portfolio.available_cash / len(tobuy) for stock in tobuy: order_value(stock, cash_per_stock) 1. 双均线策略 def initialize(context): set_benchmark('600519.XSHG') set_option('use_real_price', True) set_order_cost(OrderCost(open_tax=0, close_tax=0.001, open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock') g.security = ['600519.XSHG'] g.p1 = 5 g.p2 = 30 def handle_data(context, data): for stock in g.security: # 金叉:如果5日均线大于10日均线并且不持仓 # 死叉:如果5日均线小于10日均线并且持仓 df = attribute_history(stock, g.p2) ma10 = df['close'].mean() ma5 = df['close'][-5:].mean() if ma10 > ma5 and stock in context.portfolio.positions: # 死叉 order_target(stock, 0) if ma10 < ma5 and stock not in context.portfolio.positions: # 金叉 order_value(stock, context.portfolio.available_cash * 0.8) # record(ma5=ma5, ma10=ma10) 2. 因子选股 def initialize(context): set_benchmark('000002.XSHG') set_option('use_real_price', True) set_order_cost(OrderCost(open_tax=0, close_tax=0.001, open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock') g.security = get_index_stocks('000002.XSHG') g.q = query(valuation).filter(valuation.code.in_(g.security)) g.N = 20 run_monthly(handle, 1) def handle(context): df = get_fundamentals(g.q)[['code', 'market_cap']] df = df.sort('market_cap').iloc[:g.N,:] to_hold = df['code'].values for stock in context.portfolio.positions: if stock not in to_hold: order_target(stock, 0) to_buy = [stock for stock in to_hold if stock not in context.portfolio.positions] if len(to_buy) > 0: cash_per_stock = context.portfolio.available_cash / len(to_buy) for stock in to_buy: order_value(stock, cash_per_stock) 3. 多因子选股 def initialize(context): set_benchmark('000002.XSHG') set_option('use_real_price', True) set_order_cost(OrderCost(open_tax=0, close_tax=0.001, open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock') g.security = get_index_stocks('000002.XSHG') g.q = query(valuation, indicator).filter(valuation.code.in_(g.security)) g.N = 20 run_monthly(handle, 1) def handle(context): df = get_fundamentals(g.q)[['code', 'market_cap', 'roe']] df['market_cap'] = (df['market_cap'] - df['market_cap'].min()) / (df['market_cap'].max()-df['market_cap'].min()) df['roe'] = (df['roe'] - df['roe'].min()) / (df['roe'].max()-df['roe'].min()) df['score'] = df['roe']-df['market_cap'] df = df.sort('score').iloc[-g.N:,:] to_hold = df['code'].values for stock in context.portfolio.positions: if stock not in to_hold: order_target(stock, 0) to_buy = [stock for stock in to_hold if stock not in context.portfolio.positions] if len(to_buy) > 0: cash_per_stock = context.portfolio.available_cash / len(to_buy) for stock in to_buy: order_value(stock, cash_per_stock) 4. 均值回归 import jqdata import math import numpy as np import pandas as pd def initialize(context): set_option('use_real_price', True) set_order_cost(OrderCost(close_tax=0.001, open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock') set_benchmark('000002.XSHG') g.security = get_index_stocks('000002.XSHG') g.ma_days = 30 g.stock_num = 10 run_monthly(handle, 1) def handle(context): sr = pd.Series(index=g.security) for stock in sr.index: ma = attribute_history(stock, g.ma_days)['close'].mean() p = get_current_data()[stock].day_open ratio = (ma-p)/ma sr[stock] = ratio tohold = sr.nlargest(g.stock_num).index.values # print(tohold) # to_hold = # for stock in context.portfolio.positions: if stock not in tohold: order_target_value(stock, 0) tobuy = [stock for stock in tohold if stock not in context.portfolio.positions] if len(tobuy)>0: cash = context.portfolio.available_cash cash_every_stock = cash / len(tobuy) for stock in tobuy: order_value(stock, cash_every_stock)