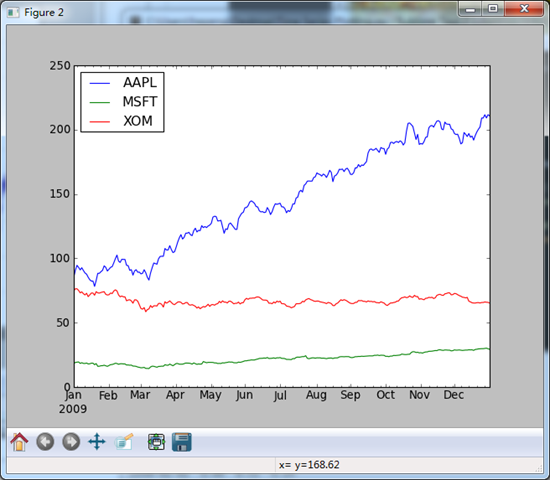

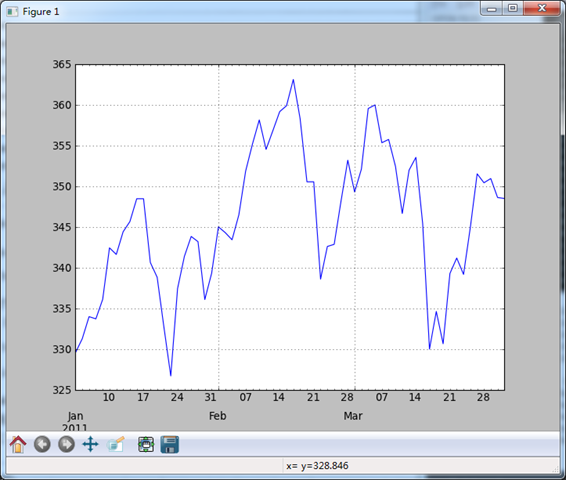

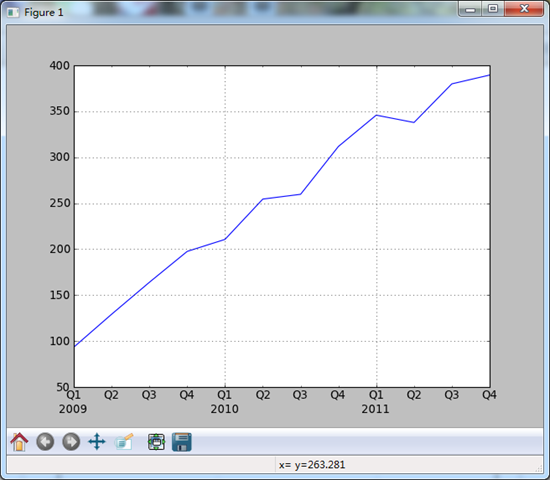

7、时间序列绘图

pandas时间序列的绘图功能在日期格式化方面比matplotlib原生的要好。

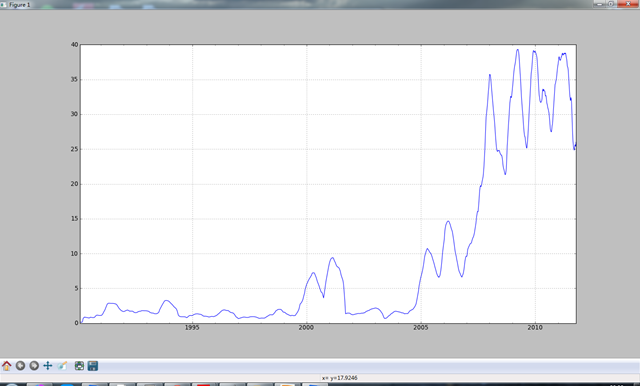

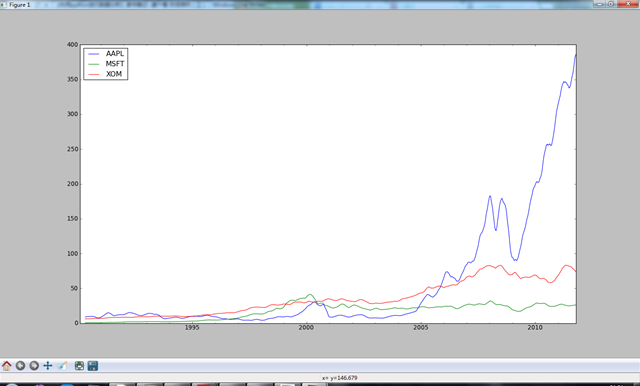

#-*- coding:utf-8 -*- import numpy as np import pandas as pd import matplotlib.pyplot as plt import datetime as dt from pandas import Series,DataFrame from datetime import datetime from dateutil.parser import parse import time from pandas.tseries.offsets import Hour,Minute,Day,MonthEnd import pytz #下面两个参数,一个是解析日期形式,一个是将第一列作为行名 close_px_all = pd.read_csv('E:\stock_px.csv',parse_dates = True,index_col = 0) print close_px_all.head(),' ' close_px = close_px_all[['AAPL','MSFT','XOM']] close_px = close_px.resample('B',fill_method = 'ffill') print close_px.head() #注意下面的索引方式即可 close_px['AAPL'].plot() close_px.ix['2009'].plot() close_px['AAPL'].ix['01-2011':'03-2011'].plot() #季度型频率的数据会用季度标记进行格式化,这种事情手工的话会很费力……(真是有道理……) appl_q = close_px['AAPL'].resample('Q-DEC',fill_method = 'ffill') appl_q.ix['2009':].plot() #作者说交互方式右键按住日期会动态展开或收缩,实际自己做,没效果…… plt.show() >>> AA AAPL GE IBM JNJ MSFT PEP SPX XOM 1990-02-01 4.98 7.86 2.87 16.79 4.27 0.51 6.04 328.79 6.12 1990-02-02 5.04 8.00 2.87 16.89 4.37 0.51 6.09 330.92 6.24 1990-02-05 5.07 8.18 2.87 17.32 4.34 0.51 6.05 331.85 6.25 1990-02-06 5.01 8.12 2.88 17.56 4.32 0.51 6.15 329.66 6.23 1990-02-07 5.04 7.77 2.91 17.93 4.38 0.51 6.17 333.75 6.33 AAPL MSFT XOM 1990-02-01 7.86 0.51 6.12 1990-02-02 8.00 0.51 6.24 1990-02-05 8.18 0.51 6.25 1990-02-06 8.12 0.51 6.23 1990-02-07 7.77 0.51 6.33 [Finished in 37.5s]

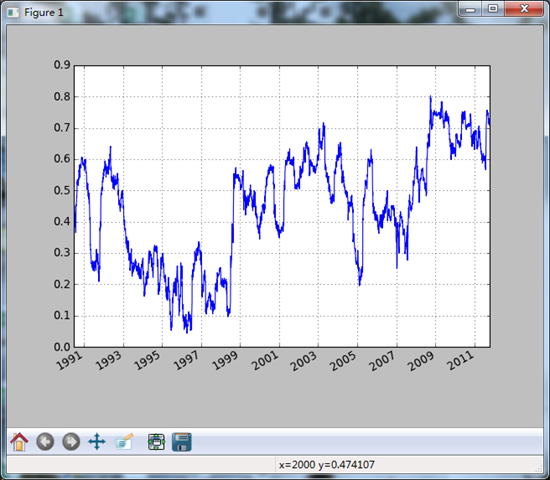

下面是作出的几张图:

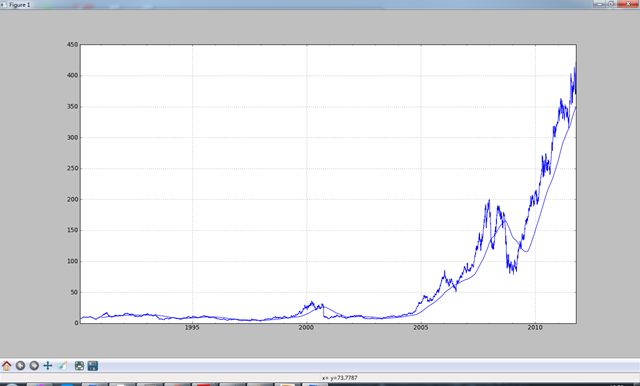

8、移动窗口函数

在移动窗口(可以带有指数衰减权数)上计算的各种统计函数也是一类常见于时间序列的数组变换。作者将其称为移动窗口函数(moving window function),其中还包括那些窗口不定长的函数(如指数加权移动平均)。跟其他统计函数一样,移动窗口函数也会自动排除缺失值。这样的函数通常需要指定一些数量的非NA观测值。

#-*- coding:utf-8 -*- import numpy as np import pandas as pd import matplotlib.pyplot as plt import datetime as dt from pandas import Series,DataFrame from datetime import datetime from dateutil.parser import parse import time from pandas.tseries.offsets import Hour,Minute,Day,MonthEnd import pytz #rolling_mean是其中最简单的一个。它接受一个TimeSeries或DataFrame以及一个window(表示期数) close_px_all = pd.read_csv('E:\stock_px.csv',parse_dates = True,index_col = 0) print close_px_all.head(),' ' close_px = close_px_all[['AAPL','MSFT','XOM']] close_px = close_px.resample('B',fill_method = 'ffill') close_px.AAPL.plot() pd.rolling_mean(close_px.AAPL,250).plot() plt.show() #默认情况下,诸如rolling_mean这样的涵涵素需要指定数量的非NA观测值。可以修改该行为以解决缺失数据的问题,其实, #在时间序列开始处尚不足窗口期的那些数据就是个特例(也就是前250期均线值是没有的) #看一下下面的图 #有个参数是min_periods,文档中说的是窗口中应该有值的最小的序列标号,可是如果是250期的标准差值,250之前怎么会有数呢?。。。难道是自动转换了周期? #YES!确实是这样,min_periods是指自这个标号开始,计算前面所有数的std,比如min_periods = 10时,计算前10个数的,min_periods = 20时,计算前20个数的,知道min_periods = 250为止,这就是所谓的“指定的非NA观测值” close_px.AAPL.plot() appl_std250 = pd.rolling_std(close_px.AAPL,250,min_periods = 10) print appl_std250[:15] appl_std250.plot() plt.show() >>> AA AAPL GE IBM JNJ MSFT PEP SPX XOM 1990-02-01 4.98 7.86 2.87 16.79 4.27 0.51 6.04 328.79 6.12 1990-02-02 5.04 8.00 2.87 16.89 4.37 0.51 6.09 330.92 6.24 1990-02-05 5.07 8.18 2.87 17.32 4.34 0.51 6.05 331.85 6.25 1990-02-06 5.01 8.12 2.88 17.56 4.32 0.51 6.15 329.66 6.23 1990-02-07 5.04 7.77 2.91 17.93 4.38 0.51 6.17 333.75 6.33 1990-02-01 NaN 1990-02-02 NaN 1990-02-05 NaN 1990-02-06 NaN 1990-02-07 NaN 1990-02-08 NaN 1990-02-09 NaN 1990-02-12 NaN 1990-02-13 NaN 1990-02-14 0.148189 1990-02-15 0.141003 1990-02-16 0.135454 1990-02-19 0.130502 1990-02-20 0.128690 1990-02-21 0.124108 Freq: B [Finished in 4.6s]

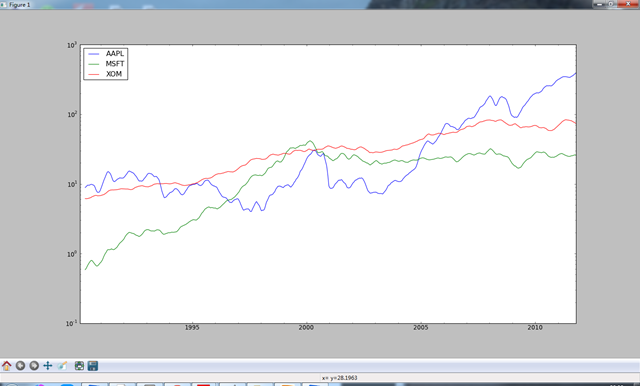

要计算扩展窗口平均(expanding window mean),可以将扩展窗口看作一个特殊的窗口,其长度与时间序列一样,但只需一期或多期即可计算一个值。

#通过rolling_mean定义扩展平均 expanding_mean = lambda x:rolling_mean(x,len(x),min_periods = 1) #对DataFrame调用rolling_mean(以及其他类似函数)会将转换应用到所有列上 #下面的logy是将纵坐标显示为科学计数法,暂时搞不懂怎么变换的 mean_60 = pd.rolling_mean(close_px,60).plot() mean_60 = pd.rolling_mean(close_px,60).plot(logy = True) #print mean_60[(len(mean_60) - 20):len(mean_60)] plt.show() ''' ts = pd.Series(range(10), index=pd.date_range('1/1/2000', periods=10)) #ts = np.exp(ts.cumsum()) print ts print np.log(ts) ts.plot(logy=True) plt.show() '''

-

指数加权函数

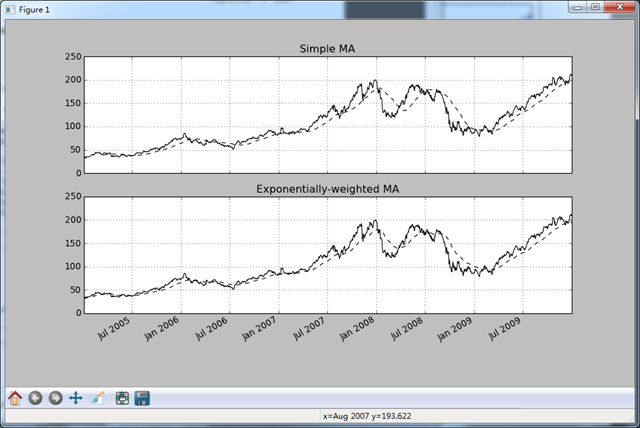

另一种使用固定大小窗口及相等权数观测值的方法是,定义一个衰减因子(decay factor)常量,以便使近期的观测值拥有更大的权数。衰减因子的定义方式有很多,比较流行的是使用时间间隔(span),它可以使结果兼容于窗口大小等于时间间隔的简单移动窗口函数。

fig,axes = plt.subplots(nrows = 2,ncols = 1,sharex = True,sharey = True,figsize = (12,7)) aapl_px = close_px.AAPL['2005':'2009'] ma60 = pd.rolling_mean(aapl_px,60,min_periods = 50) ewma60 = pd.ewma(aapl_px,span = 60) aapl_px.plot(style = 'k-',ax = axes[0]) ma60.plot(style = 'k--',ax = axes[0]) aapl_px.plot(style = 'k-',ax = axes[1]) ewma60.plot(style = 'k--',ax = axes[1]) axes[0].set_title('Simple MA') axes[1].set_title('Exponentially-weighted MA') plt.show()

-

二元移动窗口函数

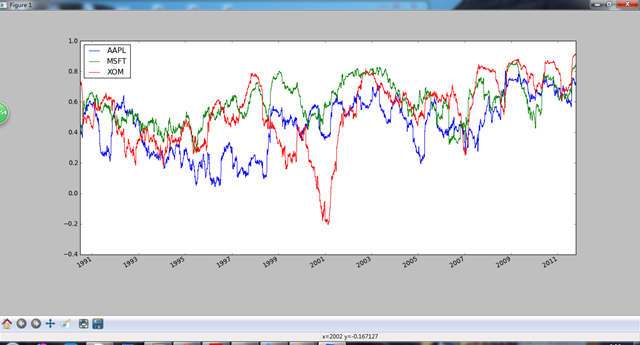

有些统计运算(如相关系数和协方差)需要在两个时间序列上执行。比如,金融分析师常常对某只股票对某个参数(如标普500指数)的相关系数感兴趣。我们可以通过计算百分比变化并使用rolling_corr的方式得到该结果。

#-*- coding:utf-8 -*- import numpy as np import pandas as pd import matplotlib.pyplot as plt import datetime as dt from pandas import Series,DataFrame from datetime import datetime from dateutil.parser import parse import time from pandas.tseries.offsets import Hour,Minute,Day,MonthEnd import pytz #rolling_mean是其中最简单的一个。它接受一个TimeSeries或DataFrame以及一个window(表示期数) close_px_all = pd.read_csv('E:\stock_px.csv',parse_dates = True,index_col = 0) print close_px_all.head(),' ' close_px = close_px_all[['AAPL','MSFT','XOM']] spx_px = close_px_all['SPX'] print spx_px #下面是将spx_px数据后移一位,减1是将数据减1,当然后面的是先除,再减1 #print spx_px.shift(1) - 1 spx_rets = spx_px / spx_px.shift(1) - 1 #看一下,下面的函数是跟上面的一样,作者是为了展示函数才这么写的 #spx_rets_pct_change = spx_px.pct_change() #print spx_rets_pct_change[:10] print spx_rets[:10],' ' returns = close_px.pct_change() print returns[:10] corr = pd.rolling_corr(returns.AAPL,spx_rets,125,min_periods = 100) corr.plot() plt.show() >>> AA AAPL GE IBM JNJ MSFT PEP SPX XOM 1990-02-01 4.98 7.86 2.87 16.79 4.27 0.51 6.04 328.79 6.12 1990-02-02 5.04 8.00 2.87 16.89 4.37 0.51 6.09 330.92 6.24 1990-02-05 5.07 8.18 2.87 17.32 4.34 0.51 6.05 331.85 6.25 1990-02-06 5.01 8.12 2.88 17.56 4.32 0.51 6.15 329.66 6.23 1990-02-07 5.04 7.77 2.91 17.93 4.38 0.51 6.17 333.75 6.33 1990-02-01 328.79 1990-02-02 330.92 1990-02-05 331.85 1990-02-06 329.66 1990-02-07 333.75 1990-02-08 332.96 1990-02-09 333.62 1990-02-12 330.08 1990-02-13 331.02 1990-02-14 332.01 1990-02-15 334.89 1990-02-16 332.72 1990-02-20 327.99 1990-02-21 327.67 1990-02-22 325.70 ... 2011-09-26 1162.95 2011-09-27 1175.38 2011-09-28 1151.06 2011-09-29 1160.40 2011-09-30 1131.42 2011-10-03 1099.23 2011-10-04 1123.95 2011-10-05 1144.03 2011-10-06 1164.97 2011-10-07 1155.46 2011-10-10 1194.89 2011-10-11 1195.54 2011-10-12 1207.25 2011-10-13 1203.66 2011-10-14 1224.58 Name: SPX, Length: 5472 1990-02-01 NaN 1990-02-02 0.006478 1990-02-05 0.002810 1990-02-06 -0.006599 1990-02-07 0.012407 1990-02-08 -0.002367 1990-02-09 0.001982 1990-02-12 -0.010611 1990-02-13 0.002848 1990-02-14 0.002991 Name: SPX AAPL MSFT XOM 1990-02-01 NaN NaN NaN 1990-02-02 0.017812 0.000000 0.019608 1990-02-05 0.022500 0.000000 0.001603 1990-02-06 -0.007335 0.000000 -0.003200 1990-02-07 -0.043103 0.000000 0.016051 1990-02-08 -0.007722 0.000000 0.003160 1990-02-09 0.037613 0.019608 0.003150 1990-02-12 -0.007500 0.000000 -0.023548 1990-02-13 0.015113 0.000000 0.001608 1990-02-14 -0.007444 0.000000 -0.004815 [Finished in 50.8s]

假如现在想同时计算多只股票与标普的相关系数。只需传入一个TimeSeries和一个DataFrame,rolling_corr就会自动计算TimeSeries与DataFrame各列的相关系数。

corr = pd.rolling_corr(returns,spx_rets,125,min_periods = 100)

corr.plot()

plt.show()

-

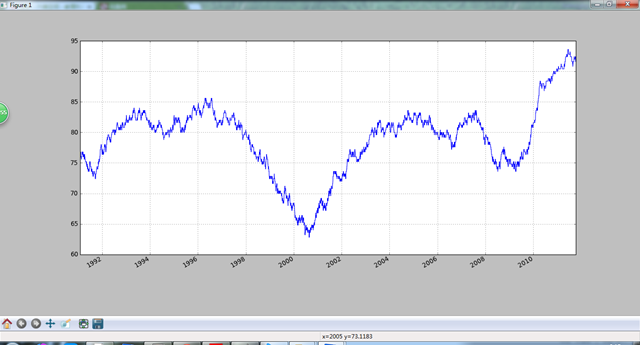

用户自定义的移动窗口函数

rolling_apply函数使你能够在移动窗口上应用自己设计的数组函数。唯一的要求就是:该函数要能从数组的各个片段中产生单个值。比如,当用rolling_quantile计算样本分位数时,可能对样本中特定值的百分等级感兴趣。

#-*- coding:utf-8 -*- import numpy as np import pandas as pd import matplotlib.pyplot as plt import datetime as dt from pandas import Series,DataFrame from datetime import datetime from dateutil.parser import parse import time from pandas.tseries.offsets import Hour,Minute,Day,MonthEnd import pytz from scipy.stats import percentileofscore #rolling_mean是其中最简单的一个。它接受一个TimeSeries或DataFrame以及一个window(表示期数) close_px_all = pd.read_csv('E:\stock_px.csv',parse_dates = True,index_col = 0) close_px = close_px_all[['AAPL','MSFT','XOM']] returns = close_px.pct_change() #这里的percentileofscore是指,0.02在x中的位置是x中的百分比

#AAPL %2回报率的百分等级

score_at_2percent = lambda x:percentileofscore(x,0.02) result = pd.rolling_apply(returns.AAPL,250,score_at_2percent) result.plot() plt.show()

9、性能和内存使用方面的注意事项

TimeSeries和Period都是以64位整数表示的(即NumPy的datetime64数据类型)。也就是说,对于每个数据点,其时间戳需要占用8字节内存。因此,含有一百万个float64数据点的时间序列需要占用大约16MB的内存空间。由于pandas会尽量在多个时间序列之间共享索引,所以创建现有时间序列的视图不会占用更多内存。此外,低频率索引(日以上)会被存放在一个中心缓存中,所以任何固定频率的索引都是该日期缓存的视图。所以。如果你有一个很大的低频率时间序列,索引所占用的内存空间将不会很大。

性能方面,pandas对数据对齐(两个不同索引的ts1 + ts2的幕后工作)和重采样运算进行了高度优化。下面这个例子将一亿个数据点聚合为OHLC:

#-*- coding:utf-8 -*- import numpy as np import pandas as pd import matplotlib.pyplot as plt import datetime as dt from pandas import Series,DataFrame from datetime import datetime from dateutil.parser import parse import time from pandas.tseries.offsets import Hour,Minute,Day,MonthEnd import pytz rng = pd.date_range('1/1/2000',periods = 10000000,freq = '10ms') ts = Series(np.random.randn(len(rng)),index = rng) print ts,' ' print ts.resample('15min',how = 'ohlc'),' ' #下面测试一下代码运行时间,下面运行不成功 #%timeit ts.resample('15min',how = 'ohlc') #换句话说,聚合的频率越高,耗费时间越多,但是,但是仍然是非常高效的 >>> 2000-01-01 00:00:00 -0.681229 2000-01-01 00:00:00.010000 -1.231560 2000-01-01 00:00:00.020000 0.437656 2000-01-01 00:00:00.030000 2.134065 2000-01-01 00:00:00.040000 0.264029 2000-01-01 00:00:00.050000 -2.273143 2000-01-01 00:00:00.060000 1.519468 2000-01-01 00:00:00.070000 -0.052764 2000-01-01 00:00:00.080000 1.329301 2000-01-01 00:00:00.090000 -1.078996 2000-01-01 00:00:00.100000 -1.121855 2000-01-01 00:00:00.110000 -0.157845 2000-01-01 00:00:00.120000 0.453539 2000-01-01 00:00:00.130000 0.043068 2000-01-01 00:00:00.140000 0.378264 ... 2000-01-02 03:46:39.850000 -0.444970 2000-01-02 03:46:39.860000 0.296446 2000-01-02 03:46:39.870000 -1.051884 2000-01-02 03:46:39.880000 0.612868 2000-01-02 03:46:39.890000 0.682818 2000-01-02 03:46:39.900000 0.375605 2000-01-02 03:46:39.910000 -0.843553 2000-01-02 03:46:39.920000 -0.861029 2000-01-02 03:46:39.930000 0.349835 2000-01-02 03:46:39.940000 0.231722 2000-01-02 03:46:39.950000 -0.268164 2000-01-02 03:46:39.960000 -1.537572 2000-01-02 03:46:39.970000 -0.634842 2000-01-02 03:46:39.980000 -1.110032 2000-01-02 03:46:39.990000 0.071214 Freq: 10L, Length: 10000000 open high low close 2000-01-01 00:00:00 -0.681229 -0.681229 -0.681229 -0.681229 2000-01-01 00:15:00 -1.231560 4.113992 -4.589095 -0.241367 2000-01-01 00:30:00 1.171302 4.593611 -4.329438 -0.099641 2000-01-01 00:45:00 -0.720612 4.432697 -4.658295 -2.278497 2000-01-01 01:00:00 0.119403 4.259349 -4.922511 1.899723 2000-01-01 01:15:00 1.168395 4.351551 -4.087221 -0.124419 2000-01-01 01:30:00 1.888486 4.288424 -4.540685 0.337621 2000-01-01 01:45:00 0.263643 4.412893 -4.362212 -1.125978 2000-01-01 02:00:00 1.398256 4.301166 -4.140143 0.693118 2000-01-01 02:15:00 -0.307263 4.353092 -4.417690 -1.647730 2000-01-01 02:30:00 1.028139 4.727692 -4.089063 0.242530 2000-01-01 02:45:00 0.857454 3.946653 -4.745711 0.270212 2000-01-01 03:00:00 -0.925215 4.544331 -4.261408 -0.616690 2000-01-01 03:15:00 -0.008779 3.958481 -4.016185 -1.055645 2000-01-01 03:30:00 0.649988 4.939031 -4.446418 0.118234 2000-01-01 03:45:00 -0.533717 4.685563 -4.205492 0.731999 2000-01-01 04:00:00 0.511450 4.483055 -3.945226 -0.814555 2000-01-01 04:15:00 0.372549 4.449327 -4.087508 0.786998 2000-01-01 04:30:00 -1.015505 4.750429 -4.111374 0.955857 2000-01-01 04:45:00 -0.450577 4.155395 -4.628542 0.621572 2000-01-01 05:00:00 0.629534 4.144105 -4.302083 1.567992 2000-01-01 05:15:00 0.843481 4.092661 -4.509020 -0.997818 2000-01-01 05:30:00 1.026566 4.004000 -4.330091 -0.745961 2000-01-01 05:45:00 0.523910 4.286510 -4.147153 -0.334644 2000-01-01 06:00:00 1.481702 4.437908 -4.198872 0.309824 2000-01-01 06:15:00 -0.530256 4.551381 -4.218254 0.112050 2000-01-01 06:30:00 -1.224188 4.245407 -4.198838 0.973066 2000-01-01 06:45:00 0.114000 4.286166 -4.070633 -1.024489 2000-01-01 07:00:00 -2.148906 4.198777 -4.213584 2.137635 2000-01-01 07:15:00 2.716069 4.308833 -4.432955 0.196065 2000-01-01 07:30:00 -0.902512 4.315467 -4.376366 -1.944492 2000-01-01 07:45:00 0.978385 4.482707 -4.343861 -0.161608 2000-01-01 08:00:00 0.028728 4.334193 -4.995541 -1.409060 2000-01-01 08:15:00 0.254613 3.944059 -4.263927 1.022247 2000-01-01 08:30:00 -2.153415 4.282622 -4.681402 0.133295 2000-01-01 08:45:00 0.361382 4.332683 -4.124674 -1.810247 2000-01-01 09:00:00 0.218621 4.087920 -4.878364 -0.247444 2000-01-01 09:15:00 1.541770 4.709500 -4.100887 0.263939 2000-01-01 09:30:00 0.302456 4.072987 -4.402301 -0.695389 2000-01-01 09:45:00 0.758779 4.854449 -4.292967 -0.098260 2000-01-01 10:00:00 -1.033195 4.412930 -4.319737 -1.078443 2000-01-01 10:15:00 -0.702287 4.687409 -4.242148 0.108918 2000-01-01 10:30:00 2.040476 4.167678 -4.069875 -0.271023 2000-01-01 10:45:00 -1.719918 4.414900 -4.003430 0.178522 2000-01-01 11:00:00 -2.003960 4.681189 -4.407995 -1.532938 2000-01-01 11:15:00 2.071234 4.691175 -4.203442 -0.000271 2000-01-01 11:30:00 -0.335169 4.577745 -4.383428 -0.356682 2000-01-01 11:45:00 0.837294 4.158462 -4.667864 -1.214194 2000-01-01 12:00:00 -0.593185 4.491041 -4.229999 -0.906558 2000-01-01 12:15:00 -0.757815 4.283729 -4.824929 0.461968 2000-01-01 12:30:00 -0.627753 4.465840 -4.382329 1.758057 2000-01-01 12:45:00 -0.582081 4.248387 -5.043421 -1.665271 2000-01-01 13:00:00 -0.232743 4.151332 -4.197010 -1.040030 2000-01-01 13:15:00 -0.099233 4.065889 -4.025087 0.400879 2000-01-01 13:30:00 0.560333 4.441687 -4.372460 -1.212408 2000-01-01 13:45:00 0.442710 4.105972 -4.284578 -0.756200 2000-01-01 14:00:00 1.280060 4.613177 -4.435858 0.793312 2000-01-01 14:15:00 0.849877 4.445931 -4.143685 -1.522613 2000-01-01 14:30:00 1.084148 4.750917 -4.196053 0.154898 2000-01-01 14:45:00 1.055437 4.320318 -4.673456 1.022639 2000-01-01 15:00:00 0.708564 4.573142 -4.251478 -0.420195 2000-01-01 15:15:00 -2.163962 4.332879 -4.207693 0.909637 2000-01-01 15:30:00 0.316790 4.269409 -4.110165 0.698051 2000-01-01 15:45:00 -0.811775 4.356382 -4.576847 1.465054 2000-01-01 16:00:00 -0.000181 4.101318 -4.549553 -0.161170 2000-01-01 16:15:00 0.293171 4.565994 -4.279151 0.574916 2000-01-01 16:30:00 1.284430 4.438795 -4.384199 -0.357597 2000-01-01 16:45:00 0.922512 4.270791 -4.365019 -0.089139 2000-01-01 17:00:00 -1.434599 4.216443 -4.599743 -0.993626 2000-01-01 17:15:00 -2.289424 4.447081 -4.129147 -0.770931 2000-01-01 17:30:00 0.235515 4.122913 -3.901979 1.107505 2000-01-01 17:45:00 0.121232 4.316179 -4.294560 -0.325761 2000-01-01 18:00:00 1.406108 4.909856 -4.380683 -1.371316 2000-01-01 18:15:00 -0.330192 4.092084 -4.433832 0.451967 2000-01-01 18:30:00 0.069717 4.602332 -4.814984 1.041939 2000-01-01 18:45:00 -2.441102 4.077937 -4.477974 -0.284751 2000-01-01 19:00:00 1.117306 4.669111 -4.433551 1.887700 2000-01-01 19:15:00 0.482482 4.545320 -4.231923 2.098973 2000-01-01 19:30:00 0.146878 4.230201 -4.738262 0.260756 2000-01-01 19:45:00 0.491376 5.230373 -5.069700 -0.936606 2000-01-01 20:00:00 -1.075473 4.701905 -4.245575 2.898905 2000-01-01 20:15:00 1.728790 4.291821 -4.145234 -0.735600 2000-01-01 20:30:00 0.680025 4.509368 -4.176570 0.346777 2000-01-01 20:45:00 -0.603546 4.479395 -4.033444 1.901963 2000-01-01 21:00:00 -0.893833 4.472098 -4.658866 0.026791 2000-01-01 21:15:00 -0.571074 4.066533 -4.773198 0.719510 2000-01-01 21:30:00 -1.109575 4.377526 -4.154108 -0.419939 2000-01-01 21:45:00 -1.109197 4.244968 -4.476610 0.625287 2000-01-01 22:00:00 -0.500703 4.204465 -4.695903 -0.205293 2000-01-01 22:15:00 -0.474312 4.278451 -4.261542 -0.605803 2000-01-01 22:30:00 -0.929173 4.679216 -4.243371 -0.389516 2000-01-01 22:45:00 0.625107 4.588921 -3.944369 0.051261 2000-01-01 23:00:00 0.223470 4.300131 -4.556017 0.411957 2000-01-01 23:15:00 2.834194 4.669853 -4.894633 -0.172413 2000-01-01 23:30:00 0.271214 4.468473 -4.059279 -0.144921 2000-01-01 23:45:00 1.005364 4.311476 -4.373045 -0.532617 2000-01-02 00:00:00 -0.177777 4.288976 -4.784412 1.279124 2000-01-02 00:15:00 1.767240 4.268321 -4.964638 0.978593 2000-01-02 00:30:00 0.874845 4.114844 -4.735220 0.755658 2000-01-02 00:45:00 0.139810 4.480646 -4.530709 1.861165 2000-01-02 01:00:00 -1.633137 4.237701 -4.465151 1.502397 2000-01-02 01:15:00 0.497876 4.056503 -4.348021 -0.019043 2000-01-02 01:30:00 0.183521 4.369899 -4.264499 0.725734 2000-01-02 01:45:00 -0.365043 4.257799 -4.003001 -0.197835 2000-01-02 02:00:00 1.389697 4.463931 -4.166211 1.310472 2000-01-02 02:15:00 -0.829049 4.360859 -5.347301 -0.719968 2000-01-02 02:30:00 -0.257339 4.156498 -4.481656 0.804225 2000-01-02 02:45:00 -0.112207 4.238031 -4.277917 -1.851001 2000-01-02 03:00:00 1.024404 4.315122 -4.296867 1.567366 2000-01-02 03:15:00 1.506557 4.440672 -4.429984 -1.569164 2000-01-02 03:30:00 0.292707 4.088439 -3.877321 -0.169247 2000-01-02 03:45:00 -1.838429 4.056206 -4.687052 0.679375 2000-01-02 04:00:00 0.469589 3.651325 -3.386148 0.071214 [Finished in 2.6s]